2021 Year In Review: A Progressive Year For DeFi

2021 has been a historic year for cryptocurrencies. The decade-old struggles of the cryptocurrency sector has finally caught on as investors, regulators, and users alike are piling their attention towards it and helping it become a part of the mainstream.

According to a crypto analytics website, the number of people holding cryptocurrencies have more than doubled to over 220 million users this year. Investors have poured in about $30 billion into the crypto industry in 2021 alone.

Investors have invested more this year than all the previous years combined and it’s reflected in the growth of the sector. At the beginning of the year, the market was worth $770 billion. Now that we’re headed towards the next year, the market is worth over $2 trillion and has the potential to exponentially grow in the upcoming year.

Bitcoin, the king of all cryptocurrencies, continues to reign over all cryptocurrencies as it breaks into mainstream adoption as a valuable and important asset. There’s a reason why Bitcoin earned the moniker “The asset of the decade,” as it shot up to record highs at nearly $69,000 per token with a market cap of over $1 trillion.

Not only that. But Bitcoin’s performance over this year has attracted a lot of attention from regulators, investors, and users. We were fortunate to see the first Bitcoin exchange-traded fund (ETF) this year. The Bitcoin ETF attracted a lot of institutional interest and held the asset above the $40,000 threshold for the entire year despite attempts from the Chinese government to bring it down through its legislation.

Moreover, we also got to see Bitcoin crowned as the legal tender for El Salvador. Salvadorans can now buy or sell products and services using Bitcoin as their main currency. This year wasn’t just all about Bitcoin, but we got to see some new ways Cryptocurrencies could be used.

Non-fungible tokens or NFTs were all the rage this year. NFTs ushered in a new era of digital ownership, mainly in areas like digital art, fashion, and most successfully, gaming, where virtual ownership is highly regarded.

NFTs have empowered creators to express themselves through various mediums and allows them to rightfully monetize and value their digital content, whether it is music, videos, memes, art, or in-game items, without having to go through the challenges that a modern-day creator or developer has to go through.

Considering the NFT craze this year, we’re headed towards a much wider adoption of cryptocurrencies and blockchain technology. With institutional interest at a high, current reports state that nearly 20% of the U.S. has invested in cryptocurrencies one way or another.

Now with Metaverse platforms and blockchain gaming platforms booming and raking in high expectations for the next year, we’re likely going to see cryptocurrency adoption surge to record highs.

A lot of success that cryptocurrencies, NFTs, and Metaverse platforms have seen is because of Decentralized Finance or DeFi for short. DeFi enabled cryptocurrencies to be used in daily transactions.

It led to the evolution that the cryptocurrency sector very much needed. By shifting the power paradigm from centralized institutions into the hands of the people, DeFi was able to lay the foundation for cryptocurrencies to be used in the real world, whether it's through lending protocols, games, NFTs, or digital real estate.

While DeFi has been focused on producing financial protocols and institutions from cryptocurrency exchanges to lending platforms and stablecoins, heading into 2022, we could see DeFi evolving to offer a new perspective and an array of diverse use cases for the ecosystem.

DeFi Has Come A Long Way

The total amount of money on DeFi platforms, a metric called total value locked, rose to $250 billion from $19 billion at the start of the year. Countries, governments, businesses, and users alike are utilizing decentralized finance into their daily lives. The European Council, an institution that DeFines the political priorities of the European Union, recently announced their plans to assess and regulate crypto-assets and DeFi.

Just like the rise of the internet, smartphones, and cloud computer, DeFi is the next leap forward in global finance. Traditionally centralized and corporate gatekeepers of financial products and services are being outclassed by decentralized, open, and permissionless protocols enabled by DeFi.

With the total value locked in DeFi tokens growing ten-folds this year, we can expect decentralized apps (DApps) and DeFi protocols to continue to appreciate exponentially in the next year.

It’s inevitable that traditional, centralized, and outdated systems are going to be completely replaced in the future; however, what will be the product, protocol, or service that will make it happen?

Traditional finance has played an important and critical role in global finance; however, it’s heavily centralized and controlled. Traditional Finance is swarming with gatekeepers and insiders, traders need at least eight years of schooling, an advanced degree, and a lot of connections to get a chance to be accepted into this closed-door club.

However, DeFi changed all of that. Thanks to its transparent and inviting ecosystem, you don’t have to go through hassles and barriers just to get in. If you have an internet connection and smartphone, you’re all set to go, which is why DeFi is the future and it’s getting the recognition that it deserves.

Yes, there are still some drawbacks and gaps in DeFi; however, the sector is still in its infancy. And seeing how blockchain technology and the cryptocurrency sector is evolving, there’s a lot of room for improvement and opportunities.

DeFi is in line with the crypto community's core values as well as worldwide cultural and economic developments. What used to be inaccessible and expensive in traditional finance, is now starting to become affordable, transparent, and open.

Top performing DeFi Platforms 2021

AAVE

Started out in 2017 unde the name ETHLend, AAVE is considered as one of the original DeFi platforms on the market. With a market worth billions of dollars, the Aave protocol is a household name in the DeFi space.

The Aave platform is a decentralized liquidity platform that allows for borrowing assets and earning deposits. Primarily designed for lending and borrowing digital assets and cryptocurrencies, Aave brings together lenders and borrowers in a decentralized space to enable an equal opportunity lending system.

Ranked 47th in the market with a market cap worth $3.5 billion and a daily trading volume of over $500 million. Amid the DeFi boom, the Aave protocol jumped 216.7% in value this year, making it one of the largest and top performing DeFi tokens this year.

Avalanche is a promising smart-contract capable blockchain platform focused on transaction speed, low network fees, and eco-friendliness. A competitor to Ethereum, Avalanche markets themselves as the fastest smart contract platform in the blockchain industry thanks to its highly scalable, decentralized, and secure blockchain.

Launched in 2020 by the Ava Lab Team, Avalanche has solidified its place in the booming DeFi and NFT space by building connectivity with other blockchain projects such as SushiSwap, Chain Link, and the Graph.

Ranked 11th in the market, Avalanche has a market cap worth over $25 billion and daily trading volume of $913 million. Thanks to its development in the NFT and DeFi space, Avalanche has seen impressive numbers as it surged over 3,540% in 2021.

Chainlink

Chainlink is an emerging decentralized oracle service that bridges smart contracts with data from the real world using oracle technology. Chainlink has made a lot of progress in the DeFi space, ranked 5th among the top tokens in the market and 22nd in the crypto market.

Recently, the platform announced the launch of a Programming Token Bridge that will enable new communication between DeFi blockchain and help DeFi to significantly scale and avoid bottlenecks holding back the earlier generation of blockchain projects in the market.

Currently, Chainlink has a market cap worth over $9 billion and a daily trading volume of $833 million, making it one of the biggest DeFi tokens in the space.

Terra Luna

Terra Luna (LUNA) has been one of the most promising projects this year. This next generation smart contract platform is unlike others as it combines decentralized finance with stablecoins. This year, Terra Luna has been the fastest growing tokens in the DeFi space thanks to its open-source platform. The platform supports an array of diverse stablecoins that offer instant settlements, low fees, and seamless cross-border exchanges.

Ranked 9th in the market, Terra Luna has a market cap of almost $32 billion and a trading volume of $2 billion. Considering the influence Terra Luna has had on the DeFi sector this year is reflective in its 13,000% growth in value.

Polygon

Polygon (MATIC) is easily one of the most promising, well-adopted, and emerging Ethereum Layer-2 scaling solutions and decentralized application ecosystems. By emphasizing on developing features such as interoperability, scalability, and security, Polygon has seen a lot of success and adoption this year from DeFi protocols and especially NFTs.

A lot of Polygon’s success is attributed to its utility for the Ethereum Network. Polygon lifts a lot of the heavy weight that the Ethereum network faces by adding another layer. Since a majority of DeFi projects are based on the Ethereum network, Polygon has been influential in providing lesser congestion and faster speeds for the DeFi ecosystem.

Currently, Polygon is ranked 14th in market with a market cap exceeding $17 billion and a daily trading volume of almost $1.5 billion. Thanks to its heavy lifting and facilitating the NFT space, Polygon is one of the top performing tokens of this year with a 14,000% increase in value from the start of the year.

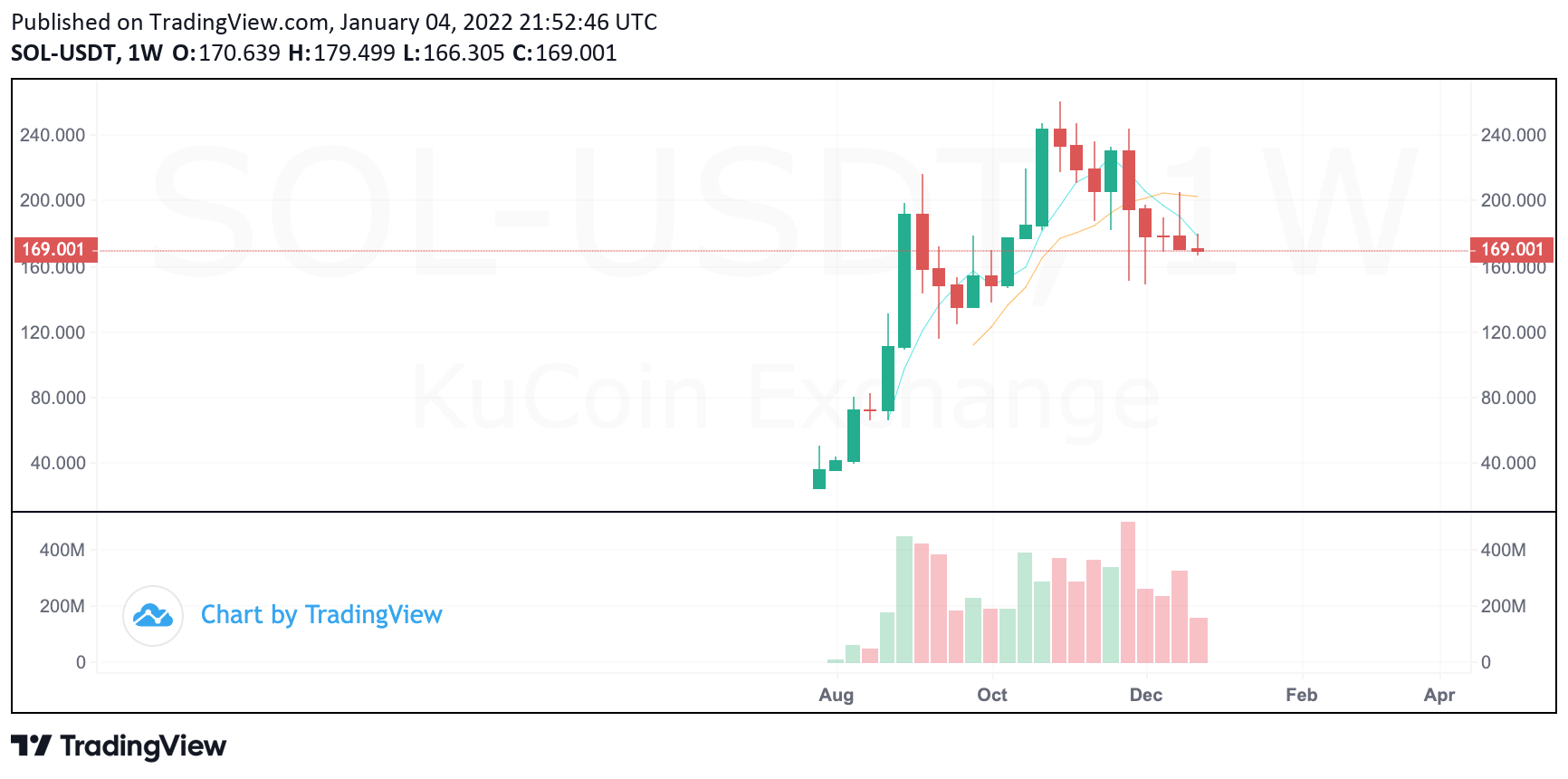

Solana

Solana is a fourth-generation blockchain that aims to provide an interoperable, scalable, and sustainable project by establishing a fast and scalable network without affecting its security or decentralization. Thanks to its eight core technologies, Solana is revolutionizing the DeFi space.

Its novel consensus mechanism is all the rage nowadays as Solana handles about 50,000 transactions per second with an average cost of just $0.00025 per transaction, making it the fastest and cheapest blockchain in the market. Solana’s capacity to handle that many transactions per seconds is being leveraged by a swarm of decentralized apps in the market.

Right now, Solana sits comfortably in the 5th spot with a market capitalization exceeding $52 billion and daily trading volumes of $1.2 billion. With a 10,000% increase in value this year, Solana can be regarded as one of the most successful prospects this year both in the DeFi and cryptocurrency space.

Uniswap

Based on the Ethereum Network, Uniswap has been one of the most successful projects in the DeFi space. It’s a pioneer decentralized exchange protocol that enables investors and traders to buy and provide liquidity directly from their crypto wallets at meagor costs.

To be more exact, Uniswap is an automated liquidity protocol. Since it has no orderbook or any centralized intermediaries to make trades, it allows users to trade without any arbiters under a decentralized ecosystem. Founded in 2018, Uniswap has been performing extremely well over the years. Its AMM provides ample liquidity for robust traffic and fast trading on its platform, making it one of the top decentralized exchanges in the market.

Uniswap performance has been pretty great this year as it ranks 26th in the market with a market cap worth $8 billion and a trading volume of $308 million. This year, Uniswap has seen great numbers as it surged 318% in this year alone.

Closing thoughts

DeFi platforms have gained a lot of recognition this year, most of which is much deserved. With billions of dollars being locked in the space, we’re seeing newer and much more efficient platforms emerge in the space.

The advancements in the DeFi sector are paving the way toward financial equality by increasing accessibility to important and once unattainable financial services. Heading into 2022, we can expect DeFi platforms to improve, optimize, and in turn, eliminate the gap for a healthy future. What do you think? What are some of your top performing DeFi tokens this year.

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange_New

Download KuCoin App >>> https://www.kucoin.com/download

Also Subscribe to our Youtube Channel >>> Listen to 60s Podcast