LUNA Soars: KuCoin Becomes Second Largest CEX Platform For Terra's Native Token

Terra’s LUNA is turning into one of the most exciting cryptocurrencies to watch as the market rebounds higher lately. What makes it worth watching?

Over the past year, LUNA/USDT has strengthened by nearly 1,200%, making it one of the top-performing digital assets. Towards the latter half of 2021, it became one of the hottest DeFi coins worth watching as the adoption of Terra’s stablecoin, TerraUSD (UST), started climbing higher.

Terra (LUNA) price chart for the past one year | Source: KuCoin

Terra now holds the distinction of being the second-largest ecosystem supporting DeFi applications, next only to Ethereum. This is especially worth celebrating considering it supports all of 21 DeFi applications, while some of its peers have hundreds of applications with far lower TVLs.

Let’s find out what makes LUNA one of the best performers in the crypto market and what to expect from it in the near term.

LUNA Overtakes ETH to Become the Second Most Staked Crypto Asset

According to an analysis by Staking Rewards, LUNA has shot past ETH to become the second most staked cryptocurrency in the world. With over $30 billion worth of LUNA staked across protocols, Terra’s native token follows SOL, which enjoys a staked value of over $37 billion. Meanwhile, Ethereum - the most popular destination for DeFi and other dApps, enjoys a staking value of just under $28 billion.

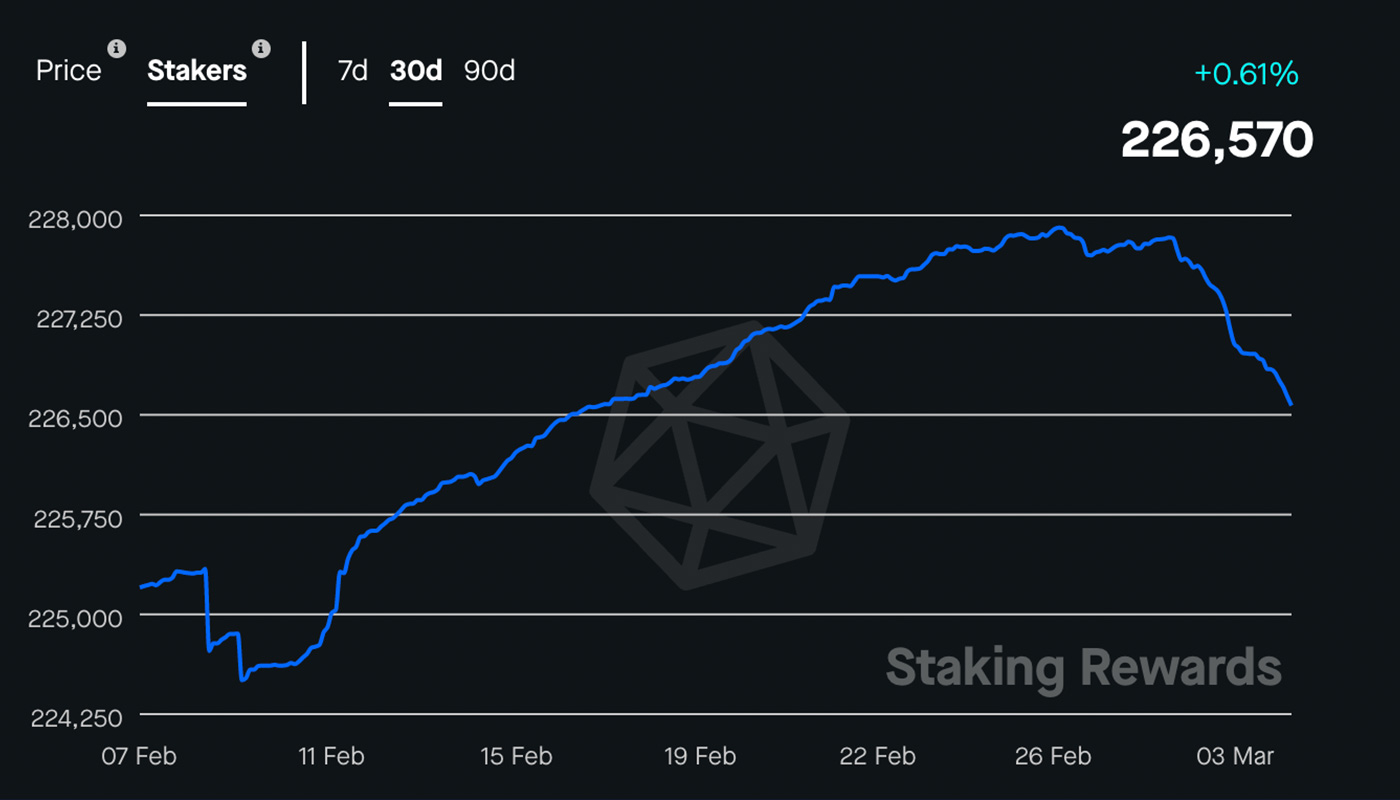

Number of unique delegation addresses on Terra’s network | Source: StakingRewards.com

Investors staking LUNA are enjoying returns of around 6.8% on average. The uptick in demand for LUNA as a crypto asset worth staking has been pushing its value higher in the crypto market lately.

Terra’s DeFi TVL Rises

As we mentioned above, the Terra blockchain is the second-largest DeFi ecosystem, right after the market leader Ethereum. This is especially interesting as Terra supports only 21 dApps in the decentralized finance space. Its key rivals, on the other hand, host hundreds of DeFi applications, as per data on Defi Llama:

· Ethereum ➠ 553

· Binance Smart Chain (BSC) ➠ 324

· Fantom ➠ 184

· Avalanche ➠ 176

Terra’s DeFi TVL stands at over $23.5 billion, accounting for 11% of the market | Source: DefiLlama.com

The four largest DeFi protocols on Terra - Anchor, Lido, Astroport, and Stader, have witnessed double-digit growth in their TVLs over the past week. In addition, Lido and Stader have seen their TVLs surge by more than 150% in a span of one month. This is especially remarkable considering the sentiment in the crypto market was mostly bearish over the past several weeks.

An uptick in Terra’s on-chain activity, especially on account of these DeFi projects, has increased the value of the LUNA token and contributed to its latest uptrend.

Terra's Integration With THORChain to Give DeFi Further Boost

Speaking of DeFi, activity in this sector is sure to rise higher in the coming days as THORChain completes its integration with the Terra blockchain. As a result of this integration, which is expected to be announced in the coming days, LUNA and UST will be made available on THORChain, which can drive up the demand for these tokens and continue to keep the LUNA token supported in the near future.

According to an update posted on 1 March 2022, THORChain has completed the successful integration of Terra into its ecosystem. However, the team is waiting for the final security sign-off from Terraform Labs - the firm behind the development of the Terra blockchain.

Terra ETP Launches to Power Institutional Interest in LUNA

There are several factors beyond DeFi that are powering LUNA’s bullish ascent in recent sessions. One interesting development is the launch of a new Terra (LUNA) ETP by Valour which was announced on 28 February 2022. The Valour Terra LUNA ETP will give institutional investors exposure to the LUNA token and drive up their interest in buying into Terra’s native token. This investment product can drive up significant buying interest in the seventh-largest cryptocurrency by market cap and keep its price supported in the near to medium term as well.

UST Adoption Picks Up, Increasing the Burn Rate of LUNA Tokens

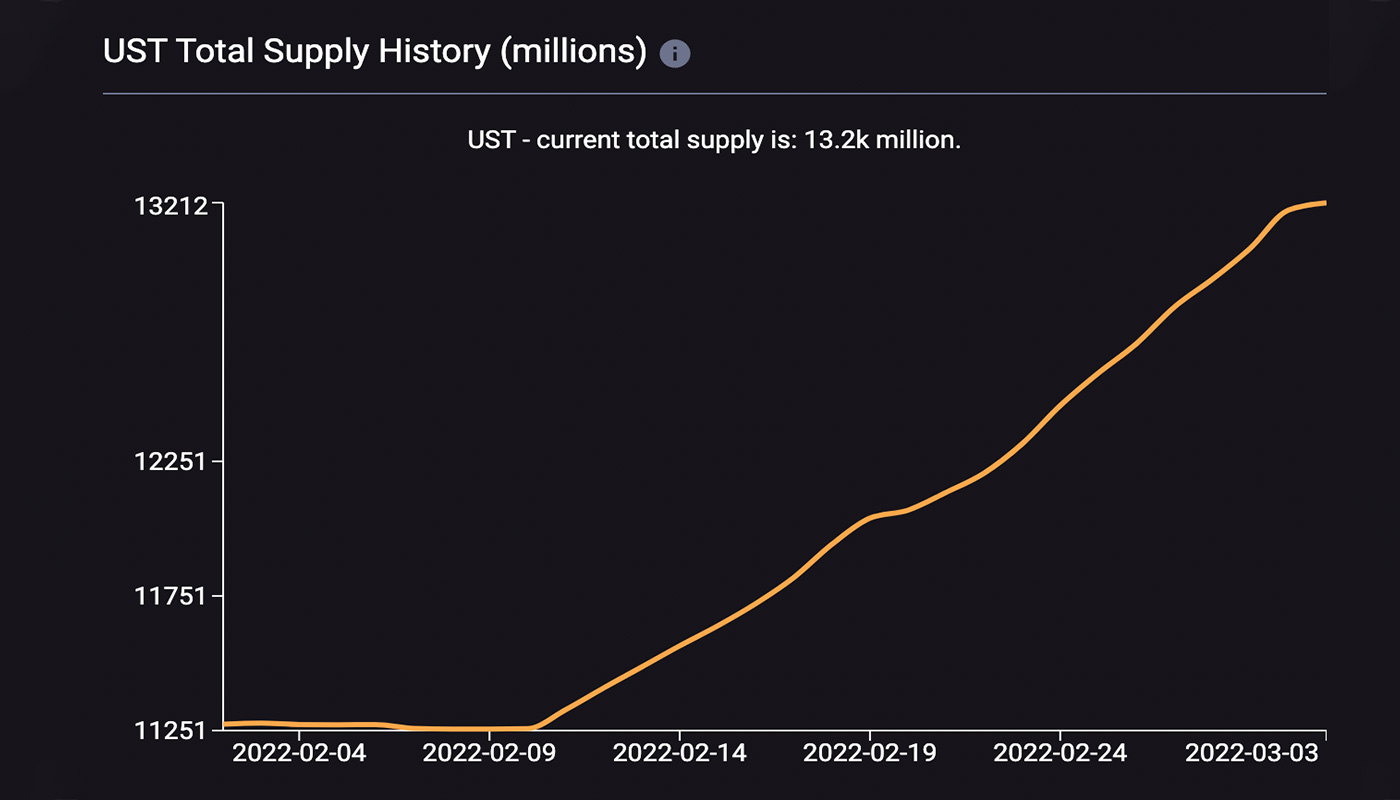

The UST stablecoin supply is on the rise, registering a nearly 15% increase in the month of February alone. An increase in demand for UST increases the pace at which LUNA tokens are burned, correspondingly increasing their value.

UST total supply history in millions | Source: SmartStake.io

Terra’s stablecoin, the TerraUSD, has seen its supply soar by around 2 million through the month of February. As a result, the Terra blockchain burned a total of $2.57 billion worth of LUNA last month. This deflationary effect which significantly reduced the number of LUNA tokens in the market has further driven up the value of the remaining tokens in circulation, as a result.

Circulating vs. non-circulating supply of LUNA token | Source: SmartStake.io

Luna Foundation Guard's Plans to Build UST Reserves

The demand for the UST stablecoin could rise even further in the coming weeks and months following last week’s announcement by the Luna Foundation Guard. The nonprofit organization charged with managing the TerraUSD confirmed raising $1 billion last week in a private sale.

The capital raised by selling LUNA tokens will be used to set up a Bitcoin-denominated Forex Reserve for the UST stablecoin. According to Terra, “Although the widespread adoption of UST as a consistently stable asset through market volatility should already refute this, a decentralized Reserve can provide an additional avenue to maintain the peg in contractionary cycles that reduces the reflexivity of the system.”

Bullish Sentiment in Crypto Market Supports LUNA

In addition to all the fundamental drivers of the positive price action in LUNA, one of the biggest supporting developments is the return of bullish sentiment in the wider cryptocurrency market. After trading under pressure for several weeks, market leader Bitcoin has been trading mostly bullish after crossing the key $40,000 mark.

This has increased investor confidence in the digital asset market and brought back buyers. Positive market sentiment has further contributed to the uptick in buying activity being seen in the LUNA token, sending its price higher.

How to Buy LUNA on KuCoin

The trading pair LUNA/USDT is one of the most liquid cryptocurrency pairs on the KuCoin exchange. KuCoin is also the second-largest CEX by trading volume to trade the LUNA token against the USDT stablecoin.

Users can buy LUNA on KuCoin by following four simple steps given below:

➢ Register for an account with KuCoin, if you don’t already have one. Once your KuCoin account is set up, all you need to do is log in to start trading LUNA/USDT.

➢ Deposit funds to your KuCoin trading account by heading to your account page and transferring cryptocurrency to the address listed on this page. If you don’t own any cryptocurrency yet, you can purchase some easily using KuCoin’s Fast Buy system, its peer-to-peer exchange, or by interacting with third-party sellers. You can also make purchases of cryptocurrencies on KuCoin using your credit and debit cards.

➢ Head to KuCoin’s spot trading section to find the LUNA/USDT trading pair. Assess the price of LUNA and enter the amount of USDT you wish to use to purchase LUNA tokens. Confirm your transaction details and in a few seconds, your account will be credited with LUNA tokens.

➢ After the transaction is completed successfully, you will gain ownership of the LUNA tokens. You can store your LUNA holdings securely either within the KuCoin platform for easy access or transfer them to an external crypto wallet for greater security.

Leveraged Tokens and Staking Become Popular Among LUNA Investors

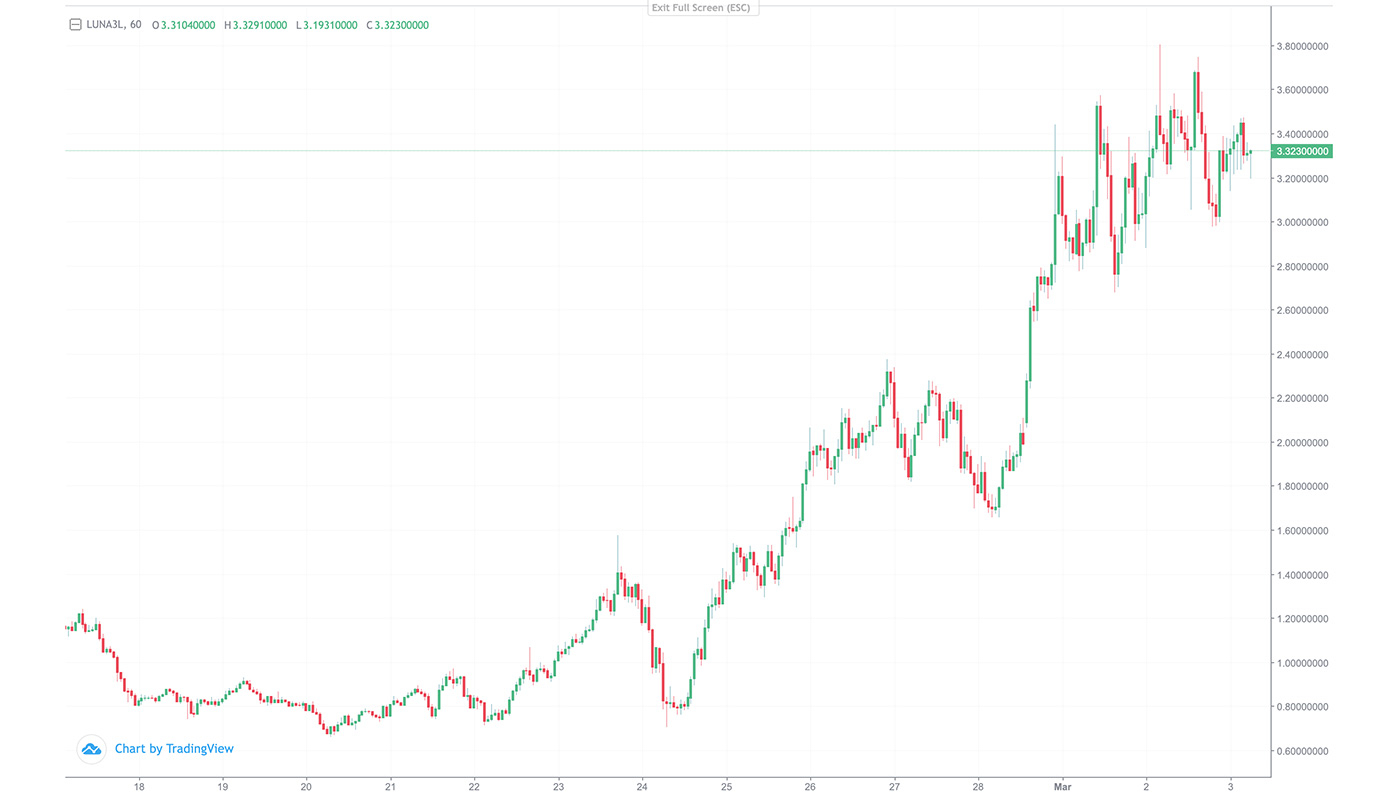

In addition to buying LUNA, KuCoin also gives you the opportunity to maximize your returns on trading the cryptocurrency via leveraged tokens and staking options. KuCoin also lets you trade LUNA3L - a leveraged token that goes 3x long on the LUNA via futures trading. KuCoin’s leveraged tokens are crypto derivatives that you can invest in the spot market for cryptocurrencies to generate significantly higher profits, when traded with care.

Leveraged token LUNA3L available for trading on KuCoin | Source: KuCoin

LUNA’s leveraged tokens derive value from the underlying asset. Without a due date on them, these perpetual contracts can be held for as long a period of time as you want. You can find out more about how KuCoin leveraged tokens work before getting started with investing in them.

The KuCoin exchange also offers the option to stake your LUNA holdings via its Soft Staking feature. You can use this option to enjoy staking rewards without locking up your crypto holdings. Soft Staking lets you compound interest efficiently while giving you greater flexibility to manage your portfolio. Find out more about KuCoin’s Soft Staking before staking LUNA tokens on the platform.

Conclusion: Future Outlook for Terra, LUNA, and UST

The future looks promising for the Terra ecosystem as well as its tokens, LUNA and UST. As an energy-efficient, Proof of Stake, blockchain network, Terra already has 73 dApps running on it as of March 2022. While most of the decentralized applications operating on the Terra blockchain are DeFi related, the ecosystem is also gradually seeing an uptick in other kinds of applications, including gaming and the metaverse. An increase in Terra’s on-chain activity can offer significant support to LUNA’s price going forwards.

Additionally, the continued uptick in adoption of the UST stablecoin can also send the LUNA burn rate higher and keep its value rising in the future. With greater cross-chain integrations and more DeFi applications across multiple blockchain ecosystems extending support to LUNA and UST, Terra’s LUNA is a worthwhile investment for crypto traders to consider.

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange_New

Download KuCoin App >>> https://www.kucoin.com/download

Also Subscribe to our Youtube Channel >>> Listen to 60s Podcast