Weekly Crypto Analysis: Bitcoin Slips to 18-Month Low, Major Reasons Behind a Crypto Sell-off

Bitcoin and other cryptocurrencies fell on Sunday, with losses for the asset class accumulating over the weekend due to US data showing persistent inflation pressures in May, the fastest rate of increase since December 1981.

On Monday, early during the Asain session, cryptocurrency prices were negative. The global crypto market cap is $1.03 trillion, having plunged from $1.28 trillion. The total crypto market volume over the last 24 hours has increased by 6.14% to $71.55 billion.

Let's go deeper and take a look at the most recent crypto market news and Bitcoin's technical outlook.

Crypto Market Overview

Bitcoin's dominance showed slight improvement, having surged from 45.23% last week to 47.23% today. The leading cryptocurrency pair, BTC/USD, is trading at $24,767.10, while Ethereum, the second-largest cryptocurrency by market capitalization, has plunged sharply to $1,269.27, down 33.17% in the last seven days.

UNUS DED LEO (LEO), Gemini Dollar (GUSD), and PAX Gold (PAXG) remained the top performers from the previous week. LEO increased by more than 4.44% to trade at $5.42, while GUSD increased by 0.58% in the last seven days, holding at $1. Finally, the PAXG increased by 0.30% to trade at $1,859.55

Cryptocurrency Market Heatmap | Source: Coin360

Last week's worst performers were Convex Finance (CVX), Fantom (FTM), and Curve DAO Token (CRV). CVX is down more than 49.63% to $4.27, FTM is down 46.56% to $0.2037, and CRV is down 45.97% in the last seven days.

The cryptocurrency market remains risk-off due to "extreme risk," as indicated by the Crypto Fear.

Top Altcoin Gainers and Losers

Top Altcoin Gainers:

➢ UNUS DED LEO (LEO) ➠ 4.44%

➢ Gemini Dollar (GUSD) ➠ 0.58%

➢ PAX Gold (PAXG) ➠ 0.30%%

Top Altcoin Losers:

➢ Convex Finance (CVX) ➠ 49.63%

➢ Fantom (FTM) ➠ 46.56%

➢ Curve DAO Token (CRV) ➠ 45.97%

News Highlights

Here are some of the events that made the previous week's crypto news section stand out:

Bitcoin Sinks to 18-Month Low as US Inflation Impact Spreads

Bitcoin fell to its lowest level in about 18 months in Asia trading Monday, as the fallout from Friday's surprise US inflation data continued to reverberate through global risk assets. The world's largest digital token fell 8.9 percent to $24,903.49, its lowest level since December 2020. Other cryptocurrencies fell as the overall sell-off continued. One of the reasons for such a massive sell-off can be linked to an increase in US inflation figures.

The consumer price index in the United States reached 291.5 points in May 2022, raising the annual inflation rate to 8.6%, the highest since December 1981, and exceeding market expectations of 8.3%. On the other hand, core inflation slowed for the second month to 6%, compared to expectations of 5.9%. Consumer prices rose 1% month on month, far exceeding forecasts of 0.7%, amid a broad-based increase in cost, though the indexes for shelter, gasoline, and food contributed the most.

With such a surge in the Inflation rate, the odds of a Fed rate hike increase, weighing on the US stocks and Cryptocurrency market.

Want to survive and make money in the bearish crypto market? Check out KuCoin’s complete guide by following the link.

Crypto Lending Service Celsius Pauses Withdrawals, Kicking Risk-off Sentiment

The Celsius Network, one of the largest crypto lenders, informed customers on Sunday evening that it is suspending withdrawals, swaps, and transfers between accounts, sparking debate and causing the price of the firm's token to fall by 60% in one hour to as low as 19 cents.

Celsius, valued at $3.25 billion in November after extending its "oversubscribed" Series B financing round to $750 million, allows users to deposit Bitcoin, Ethereum, and Tether and receive weekly interest payments. The platform can provide up to 18% interest per year, depending on the time horizon and the token. Celsius claims that 1.7 million people call it "their home for crypto."

The announcement comes after one of the most brutal weekends in the cryptocurrency market, which saw hundreds of millions of dollars liquidated. At the time of publication, Bitcoin was trading around $25,585 and Ethereum was trading around $1,346, both at lows not seen in over a year. Other high-profile cryptocurrency projects, such as Solana, BNB, and FTT, were also unavailable. The recent decline in cryptocurrency, particularly Ether, may be linked to the latest developments from the Celsius network.

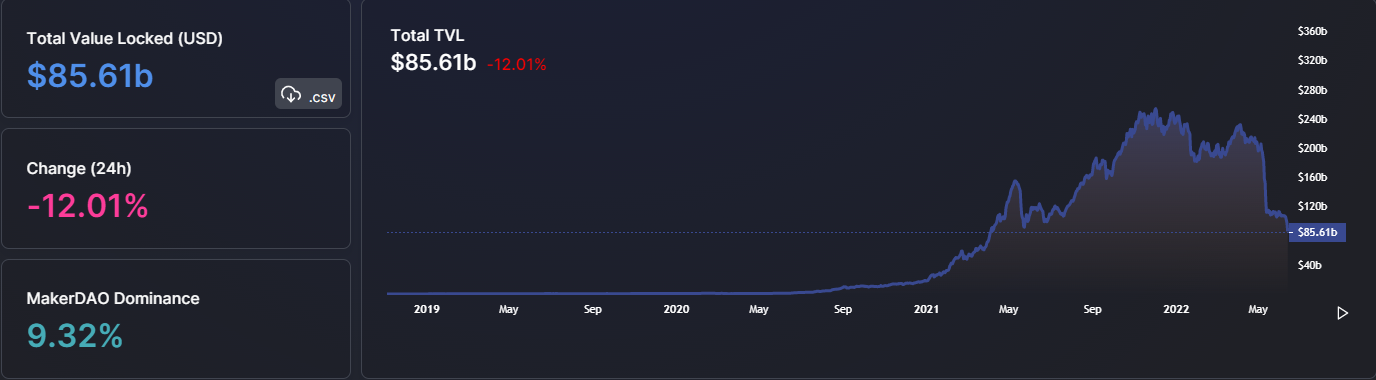

Total Value Locked (TVL) Slides by 6.45% to $91.02 Billion

Aside from market capitalization, trading volume, and total and circulating supply, total value locked (TVL) is a popular crypto indicator used by DeFi investors to assess the overall value of assets deposited across all DeFi protocols or in a single DeFi project in the US dollars or any fiat currency.

Cryptocurrencies are taking a bearish turn amid risk-off sentiment in the market. The total value locked in Defi has fallen by -12.01% to $86.6 billion, with ETH's TVL plunging by -11.40% to $55.13 billion.

Terra (LUNA) had more than $25 billion in total value locked (TVL) at the end of April, making it the second-largest decentralized finance (DeFi) ecosystem after Ethereum.

However, after the Terraform Labs ecosystem collapsed in May, DeFi blockchains were severely impacted by the ensuing crypto bear market, which worsened as the downtrend accelerated due to the direct impact of cryptocurrency prices.

Total Value Locked | Source: Defillama

While the TVL in Defi fell more than 12% in the last 24 hours, figures reveal that the TVL is currently hovering around $85.61 billion, with BSC plunging by -8.49%. As a result of the drop in TVL, the crypto market is mostly going down.

Ethereum Hits 15-Month Low as the Merge Is Delayed Again

The extension of the merge date could be one of the major reasons for Ethereum's massive selling trend. As we enter the second weekend of June, cryptocurrencies are performing poorly. Ethereum has taken a hefty hit in recent hours. Not only has the broader cryptocurrency market fallen in the aftermath of the latest US inflation report, but Ethereum developers have also indicated that the merger will be delayed.

As a result, the whole cryptocurrency market is feeling some adverse effects of the US Labor Department's consumer inflation report released on Friday. The plight of ETH holders has been exacerbated by reports that the merger has been pushed back.

According to Bloomberg, developers discovered some PoS bugs in one of the network's oldest tenets and decided to postpone the merge. So, developers decided to put off the switch from Proof-of-Work (PoW) to Proof-of-Stake (PoS) for Ethereum (ETH), which put more pressure on the price of ETH/USDT.

Crypto Calendar: Events to Watch This Week

➺ 13/06/2022 - FTX Delisting (RUNE)

➺ 13/06/2022 - Modularity AMA (MATIC)

➺ 13/06/2022 - Community Call (GNO)

➺ 14/06/2022 - Batch 5 Demo Day (CELO)

➺ 16/06/2022 - Djed AMA (ADA)

Fear and Greed Index Signals “Extreme Fear”, Bears Dominate

On Monday, the cryptocurrency market continues to remain under pressure as the Fear and Greed Index's "extreme fear" signal keeps market sentiment risk-off. The cryptocurrency market is highly emotional. When the market rises, people tend to become greedy, resulting in FOMO (Fear of missing out).

Furthermore, people frequently sell their coins in an irrational reaction to red numbers. So we try to save you from your emotional overreactions with our Fear and Greed Index.

Fear & Greed Index | Source: Alternative

The bulls may be looming around the corner as during the "extreme fear" traders typically look to buy cheaper crypto coins to sell them later at profit or hold them for long-term gains.

Bitcoin (BTC/USDT) Analysis on KuCoin Chart

The learning cryptocurrency is trading sharply bearish, having plunged from $28,000 to the $23,955 level. On the 4-hour timeframe, the Bitcoin violated the symmetrical triangle pattern which was keeping the BTC/USDT pair supported. Now that the pattern is violated, Bitcoin is heading south to the next support area of $23,750. Bitcoin has also formed “Three Black Crows” which are driving further selling in the pair.

BTC/USDT Chart on the Daily Timeframe | Source: KuCoin

On the upside, Bitcoin’s immediate resistance remains at $25,375 and $27,054. A surge in Bitcoin demand has the potential to slice through the $27,054 resistance level, exposing the price to $28,270.

The leading technical indicators such as RSI and MACD have entered the oversold zone, and Bitcoin’s major support prevails at 22,750 and 21,950. Let’s keep an eye on these support levels as they may offer a nice bounce-off.

Did you know that KuCoin offers premium TradingView charts to all its clients? With this, you can step up your Bitcoin technical analysis and easily identify various crypto chart patterns.

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>> https://www.kucoin.com/download

Also, Subscribe to our Youtube Channel >>>Listen to 60s Podcast