How to Buy Pepe (PEPE)

Price of Pepe (24h)$0.0000040156678393 3.65%Log In to Buy Pepe(PEPE)

3.65%Log In to Buy Pepe(PEPE)

Interested in buying Pepe (PEPE) or exploring other cryptocurrencies? This is the right place for you! KuCoin offers safe and easy ways to let you buy Pepe (PEPE) instantly wherever you are! Check out all the ways you can buy PEPE on KuCoin.

Buy Pepe (PEPE) on KuCoin in Four Simple Steps

Create Your Free KuCoin Account

- Sign up on KuCoin with your email address/mobile phone number and country of residence, and create a strong password to secure your account.

Secure Your Account

- Ensure stronger protection of your account by setting Google 2FA code, anti-phishing code, and trading password.

Verify Your Account

- Verify your identity by entering your personal information and uploading a valid Photo ID.

Add a Payment Method

- Add a credit/debit card or bank account after verifying your KuCoin account.

Buy Pepe (PEPE)

- Use a variety of payment options to buy Pepe on KuCoin. We'll show you how.

Choose How You Want to Buy Pepe on KuCoin

Buying cryptocurrencies is easy and intuitive on KuCoin. Let's explore the different ways of buying Pepe (PEPE).

- 1

Buy Pepe (PEPE) with crypto on the KuCoin Spot Market

With support for 700+ digital assets, the KuCoin spot market is the most popular place to buy Pepe (PEPE). Here's how to buy:1. Buy stablecoins such as USDT on KuCoin using the Fast Trade service, P2P, or through third-party sellers. Alternatively, transfer your current crypto holdings from another wallet or trading platform to KuCoin. Make sure your blockchain network is correct, since depositing crypto to the wrong address may result in loss of assets.

2. Transfer your crypto to a KuCoin Trading Account. Find your desired Pepe (PEPE) trading pairs in the KuCoin spot market. Place an order to exchange your existing crypto for Pepe (PEPE).

Tip: KuCoin offers a variety of order types to buy Pepe (PEPE) in the spot market, such as market orders for instant purchases and limit orders for buying crypto at a specified price. For more information about order types on KuCoin, click here.3. As soon as your order is successfully executed, you will be able to see your available Pepe (PEPE) in your Trading Account.

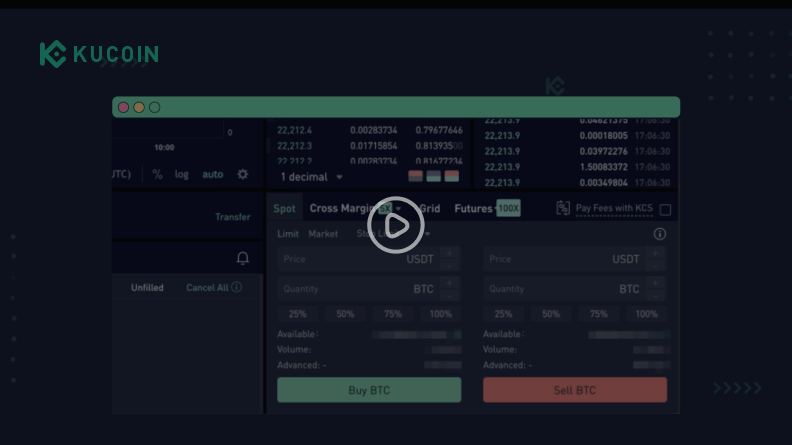

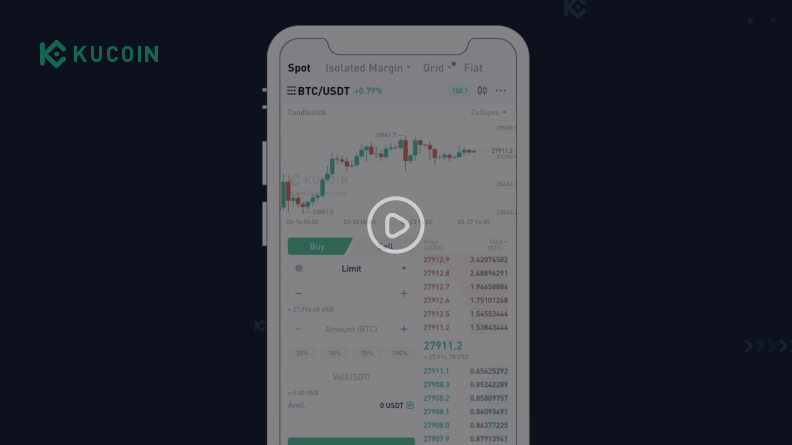

Video Tutorial

How to Buy Crypto on the Spot Market Web

How to Buy Crypto on the Spot Market App

Get Your First Pepe (PEPE) with KuCoin

Get Started Now

How to Store Pepe (PEPE)

The best way to store Pepe (PEPE) varies based on your needs and preferences. Review the pros and cons to find the best method of storing Pepe (PEPE).

- Store Pepe in Your KuCoin Account

Holding your crypto in your KuCoin account provides quick access to trading products, such as spot and futures trading, staking, lending, and more. KuCoin serves as the custodian of your crypto assets to help you avoid the hassle of securing your private keys on your own. Make sure to set up a strong password and upgrade your security settings to prevent malicious actors from accessing your funds.

- Hold Your Pepe in Non-Custodial Wallets

"Not your keys, not your coins" is a widely recognized rule in the crypto community. If security is your top concern, you can withdraw your Pepe (PEPE) to a non-custodial wallet. Storing Pepe (PEPE) in a non-custodial or self-custodial wallet grants you complete control over your private keys. You can use any type of wallet, including hardware wallets, Web3 wallets, or paper wallets. Note that this option may be less convenient if you wish to trade your Pepe (PEPE) frequently or put your assets to work. Be sure to store your private keys in a secure location as losing them may result in the permanent loss of your Pepe (PEPE).

What Can You Do with Pepe (PEPE) on KuCoin?

Hold

- Store your Pepe (PEPE) in your KuCoin account.

Trade

- Trade Pepe (PEPE) in the spot and futures markets.

Earn

- Earn passive income by staking or lending Pepe (PEPE).

Why Is KuCoin the Best Platform to Buy Pepe (PEPE)?

Safe and Trusted

Our regular Proof of Reserves (PoR) mechanism ensures that customer funds are backed by 1:1 real assets. KuCoin was named one of the Best Crypto Exchanges by Forbes in 2021 and selected by Ascent as the Best Crypto App in 2022.

High Liquidity

Boasting a high liquidity order book for all listed cryptocurrencies, KuCoin delivers a liquid trading experience with tight spreads.

Home of Crypto Gems

KuCoin supports more than 700 cryptocurrencies and is the best place to find the next crypto gem. Buy Pepe and trade it against various digital assets on KuCoin.

Intuitive Interface

Buying Pepe (PEPE) on KuCoin is quick and easy, thanks to our intuitive interface and powerful technology. Obtain PEPE in an instant when you buy on KuCoin.