Batas Risiko Kontrak Coin-Margined

Mekanisme Batas Risiko

Batas risiko adalah mekanisme manajemen risiko yang digunakan untuk membatasi risiko posisi pengguna. Di pasar dengan fluktuasi harga yang signifikan, pengguna yang memiliki posisi besar dengan leverage tinggi dapat menyebabkan kerugian besar akibat saldo negatif. KuCoin menetapkan batas risiko untuk semua akun perdagangan, yang berarti pengguna dengan posisi besar harus memiliki lebih banyak margin untuk mempertahankan posisi mereka. Hal ini mengoptimalkan manajemen risiko dan melindungi semua pengguna dari risiko tambahan.

Seiring dengan meningkatnya nilai kontrak suatu posisi, pengguna harus memilih tingkat batas risiko yang lebih tinggi, yang memerlukan margin pemeliharaan dan margin awal yang lebih tinggi.

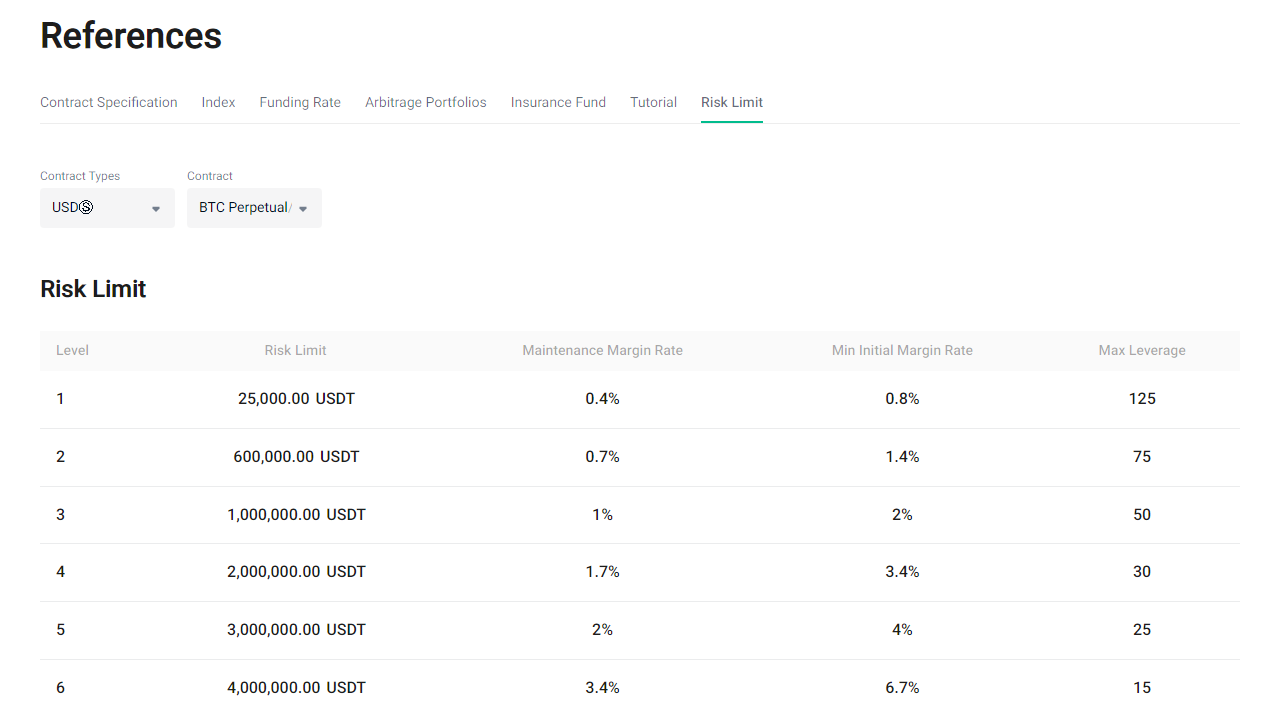

Anda dapat mengunjungi Batas Risiko untuk melihat tingkat batas risiko bagi setiap kontrak.

Batas risiko untuk kontrak coin-margined ditetapkan dalam mata uang dasar dari kontrak tersebut.

Contoh

Untuk kontrak perpetual coin-margined BTCUSD, unit batas risikonya adalah BTC, dan 1 kontrak setara dengan 1 USD.

Jika batas risiko saat ini berada di tingkat 1, leverage maksimumnya adalah 50x dan tingkat margin pemeliharaannya adalah 2%.

Saat harga BTC 40.000 USD, ukuran order maksimum pada tingkat ini = 8/(1/40000) = 320.000 kontrak.

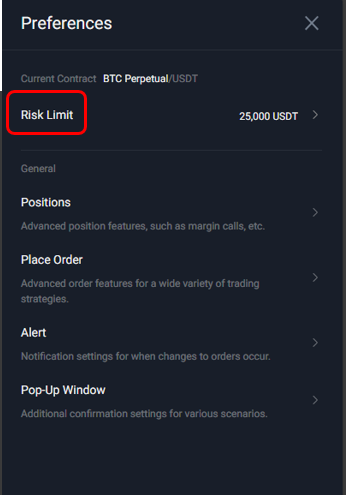

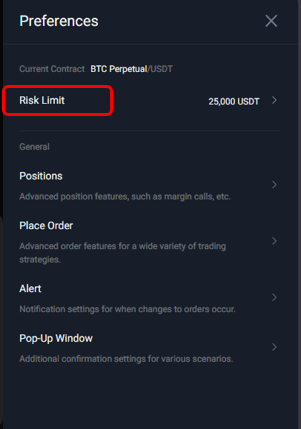

Menyesuaikan Batas Risiko

Perdagangan kontrak KuCoin menetapkan tingkat batas risiko awal bagi semua pengguna pada level terendah secara bawaan. Pengguna dapat dengan fleksibel menyesuaikan batas risiko mereka dalam “Pengaturan Preferensi Perdagangan”. Setelah mengalihkan tingkat batas risiko, leverage maksimum, tingkat margin awal, dan tingkat margin pemeliharaan sebelum dan sesudah penyesuaian akan ditampilkan. Anda dapat mengonfirmasikan perubahan Anda dan menerapkannya.

Catatan: Harap sesuaikan batas risiko saat tidak ada posisi atau order terbuka dalam kontrak saat ini.

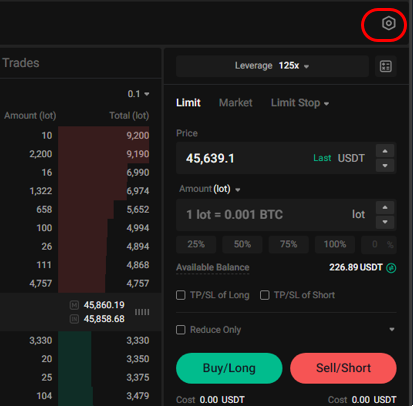

Situs web: Klik ikon pengaturan ⚙️ di sudut kanan atas halaman dan kunjungi "Preferensi Perdagangan" - "Batas Risiko".

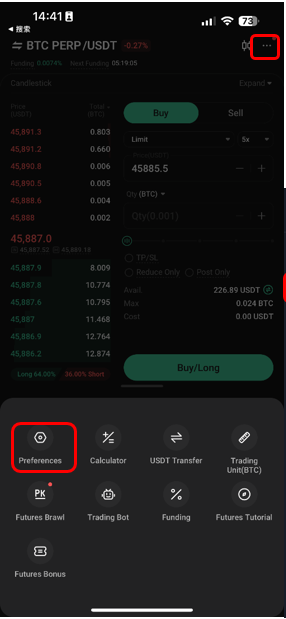

Aplikasi: Klik ikon pengaturan "..." di sudut kanan atas dan kunjungi "Preferensi Perdagangan" - "Batas Risiko".

Likuidasi Berjenjang

Bagi pengguna dengan batas risiko tinggi, KuCoin menggunakan proses likuidasi berjenjang jika terjadi likuidasi. Proses ini secara otomatis mengurangi tingkat batas risiko ke tingkat terendah. Pendekatan ini mencegah keseluruhan posisi pengguna dilikuidasi semua dalam satu waktu.

Contoh

Seorang pengguna memiliki posisi dalam kontrak perpetual coin-margined BTCUSD pada tingkat batas risiko ketiga dan memicu likuidasi. Sistem akan menurunkan posisi pengguna ke tingkat kedua, mengurangi ukuran posisi ke nilai maksimum tingkat kedua. Sistem kemudian menilai apakah posisi tersebut keluar dari risiko likuidasi. Jika iya, tidak ada pengurangan posisi lebih lanjut atau likuidasi yang akan terjadi; jika tidak, sistem akan terus mengurangi dan menurunkan posisi tersebut. Jika posisi masih memicu likuidasi pada tingkat pertama, akan dilakukan likuidasi dan pengambilalihan secara paksa.

Mulai Perdagangan Futures Anda Sekarang!

Panduan KuCoin Futures:

Terima kasih atas dukungan Anda!

Tim KuCoin Futures

Catatan: Pengguna dari negara dan wilayah yang dibatasi tidak dapat membuka perdagangan futures.