Pesanan Harga Purata Berwajaran Masa (TWAP)

Dagangan spot di KuCoin membenarkan beberapa jenis pesanan lanjutan. Panduan ini akan mengajar anda cara menetapkan pesanan Harga Purata Berwajaran Masa (TWAP).

Kandungan (Klik untuk menavigasi)

1. Apakah itu Pesanan TWAP?

2. Menetapkan Pesanan TWAP

1. Apakah itu Pesanan TWAP?

Peanan Harga Purata Berwajaran Masa (TWAP) membantu anda membahagikan pesanan besar kepada pesanan lebih kecil, dan melaksanakannya dalam kelompok. Sebagai contoh, apabila anda membuat pesanan beli dan harga pasaran adalah di bawah harga yang anda tentukan, sistem akan mencipta sub-pesanan yang lebih kecil pada harga yang lebih tinggi sedikit daripada harga jualan terbaik semasa. Sub-pesanan ini adalah pesanan beli Segera-Atau-Batal (IOC) yang lebih kecil, setiap satu dibuat pada selang waktu atau peratusan tertentu.

2. Menetapkan Pesanan TWAP

i. Parameter

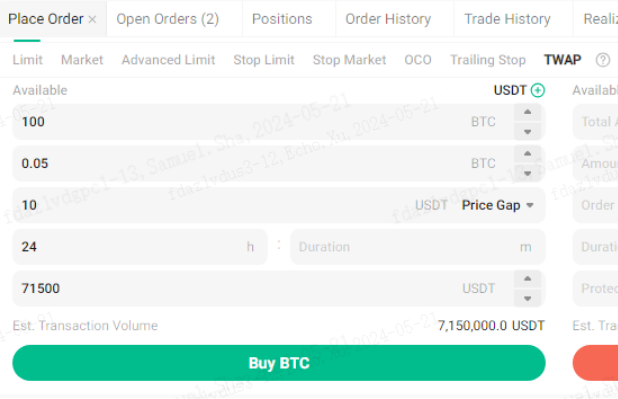

Andaikan anda ingin membeli 10 BTC dengan cepat pada kos tidak lebih tinggi daripada 71,500 USDT setiap BTC tanpa menjejaskan harga pasaran dengan ketara. Untuk melakukan ini, anda akan menggunakan pesanan TWAP untuk pelaksanaan pantas.

Tetapan anda adalah seperti berikut:

Arah: Beli

Jumlah Keseluruhan Pesanan: 10 BTC (Jumlah yang anda ingin dagangkan)

Jumlah setiap Pesanan: 0.05 BTC (Jumlah setiap sub-pesanan selepas pembahagian pesanan)

Jarak Pesanan: 10 USDT (Untuk pesanan beli, setiap sub-pesanan dibuat pada selang lebih tinggi sedikit sebanyak 10 USDT melebihi harga diminta terbaik. Semakin besar jurang atau peratusan harga, semakin tinggi kemungkinan pelaksanaan yang lebih cepat, tetapi ini juga meningkatkan kos dagangan).

Jumlah Tempoh Pesanan: 24 jam (Ini ialah jumlah masa pesanan akan dilaksanakan. Tempoh maksimum ialah 99 jam dan 59 minit. Semakin lama tempoh anda, semakin tinggi kemungkinan pesanan anda akan dilaksanakan sepenuhnya.

Harga Perlindungan: 71,500 USDT setiap BTC (Syarat pencetus untuk pesanan had. Sebagai contoh, pesanan beli hanya akan diisi jika harga diminta terbaik ditambah jarak pesanan kedua-duanya adalah di bawah harga perlindungan ini. Jika harga perlindungan ditetapkan terlalu jauh daripada harga pasaran semasa, pesanan mungkin tidak dapat diisi dengan cepat)

ii. Pelaksanaan Pesanan

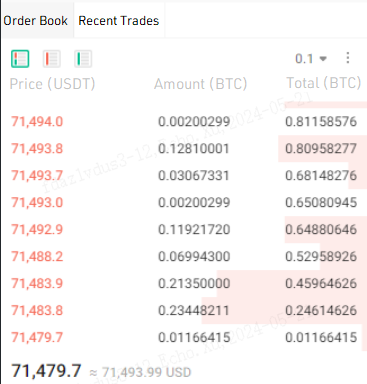

Selepas membuat pesanan, sub-pesanan anda akan secara automatik dikelompokkan dan dilaksanakan. Dengan mengandaikan buku pesanan semasa adalah seperti yang ditunjukkan di bawah:

Selang masa untuk setiap sub-pesanan dikira dengan membahagikan jumlah tempoh pesanan dalam saat dengan (jumlah pesanan / jumlah setiap pesanan) dan kemudian didarab dengan nisbah rawak. Ini berterusan sehingga jumlah yang diisi sepadan dengan jumlah pesanan, atau sehingga tempoh pesanan tamat.

Berdasarkan tetapan di atas, harga beli tertinggi ialah harga jual terbaik semasa sebanyak 71,479.7 USDT/BTC campur 10 USDT, berjumlah 71,489.7 USDT/BTC. Jumlah pesanan jual di bawah 71,489.7 USDT/BTC berjumlah 0.529589261 BTC (0.01166415 + 0.234482111 + 0.21350000 + 0.06994300), iaitu lebih daripada jumlah setiap pesanan anda. Memandangkan jumlah ini lebih besar daripada jumlah pesanan tunggal yang anda tentukan sebanyak 0.05 BTC, sistem hanya akan membuat pesanan had berdasarkan jumlah yang anda tetapkan (0.05 BTC) dan harga (71,489.97 USDT/BTC).

Jika sub-pesanan tidak diisi sepenuhnya, ia akan dibatalkan serta-merta, bermakna semua sub-pesanan adalah pesanan IOC (Segera atau Batal). Apabila harga pasaran terkini melebihi harga perlindungan (71,500 USDT/BTC), pesanan akan dijeda. Sebaik sahaja harga pelaksanaan terkini jatuh di bawah 71,500 USDT/BTC, ia disambung semula. Apabila jumlah keseluruhan yang diisi bersamaan dengan jumlahkeseluruhan pesanan, keseluruhan pesanan dianggap lengkap dan berhenti berjalan.