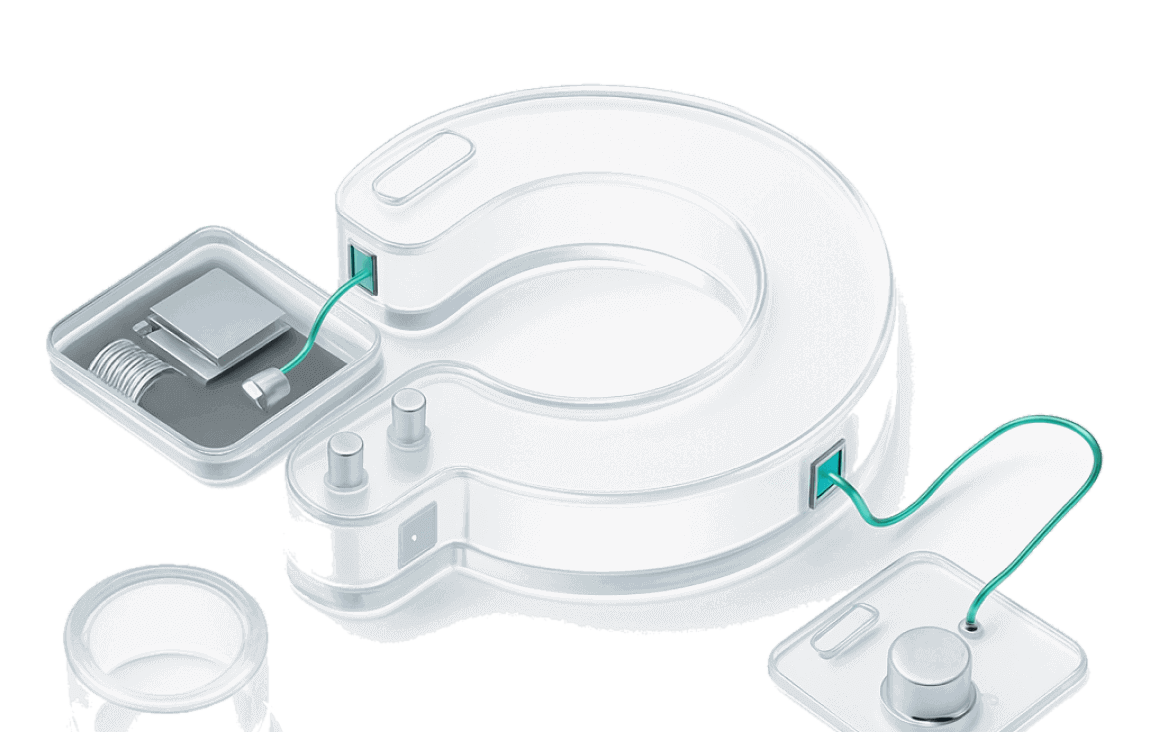

Khidmat Layan Diri

Tetapkan Semula Kaedah Pengesahan

Tetapkan Semula Pengesah Google, telefon, e-mel, dan kata laluan dagangan.

Tukar/Nyahpaut Kaedah Pengesahan

Uruskan Pengesah Google, telefon, e-mel, dan kata laluan dagangan.

Bekukan Akaun

Bekukan akaun untuk menyekat aktiviti yang mencurigakan.

Eksport Sejarah

Eksport rekod transaksi serta-merta.

Tidak Menerima Deposit Kripto

Selesaikan isu deposit yang hilang.

Tukar Kata Laluan Log Masuk

Kukuhkan keselamatan log masuk anda.

Minta pemulihan manual untuk deposit yang tersalah letak.

Minta pemulihan manual untuk deposit yang tersalah letak.

SOALAN LAZIM

Lihat SelanjutnyaPengumuman

Lihat SelanjutnyaKuCoin Niaga Hadapan Akan Mengeluarkan Kontrak Kekal AIAUSDT (12-11)

KuCoin Niaga Hadapan Akan Nyahsenarai Kontrak Kekal SKATEUSDT, FISUSDT dan VOXELUSDT (12-10)

KuCoin Futures Akan Nyahsenarai Kontrak Kekal PIGGYUSDT (12-06)

KuCoin Niaga Hadapan Akan Menyahsenarai Kontrak Kekal MILKUSDT, OBOLUSDT dan TOKENUSDT (12-05)

Masih mempunyai masalah?

Kami menyediakan khidmat pelanggan 24/7 yang sentiasa memenuhi keperluan anda.

Ada apa-apa masalah lain?

Kami menyediakan khidmat pelanggan 24/7 yang sentiasa memenuhi keperluan anda.