KuCoin News

KuCoin News

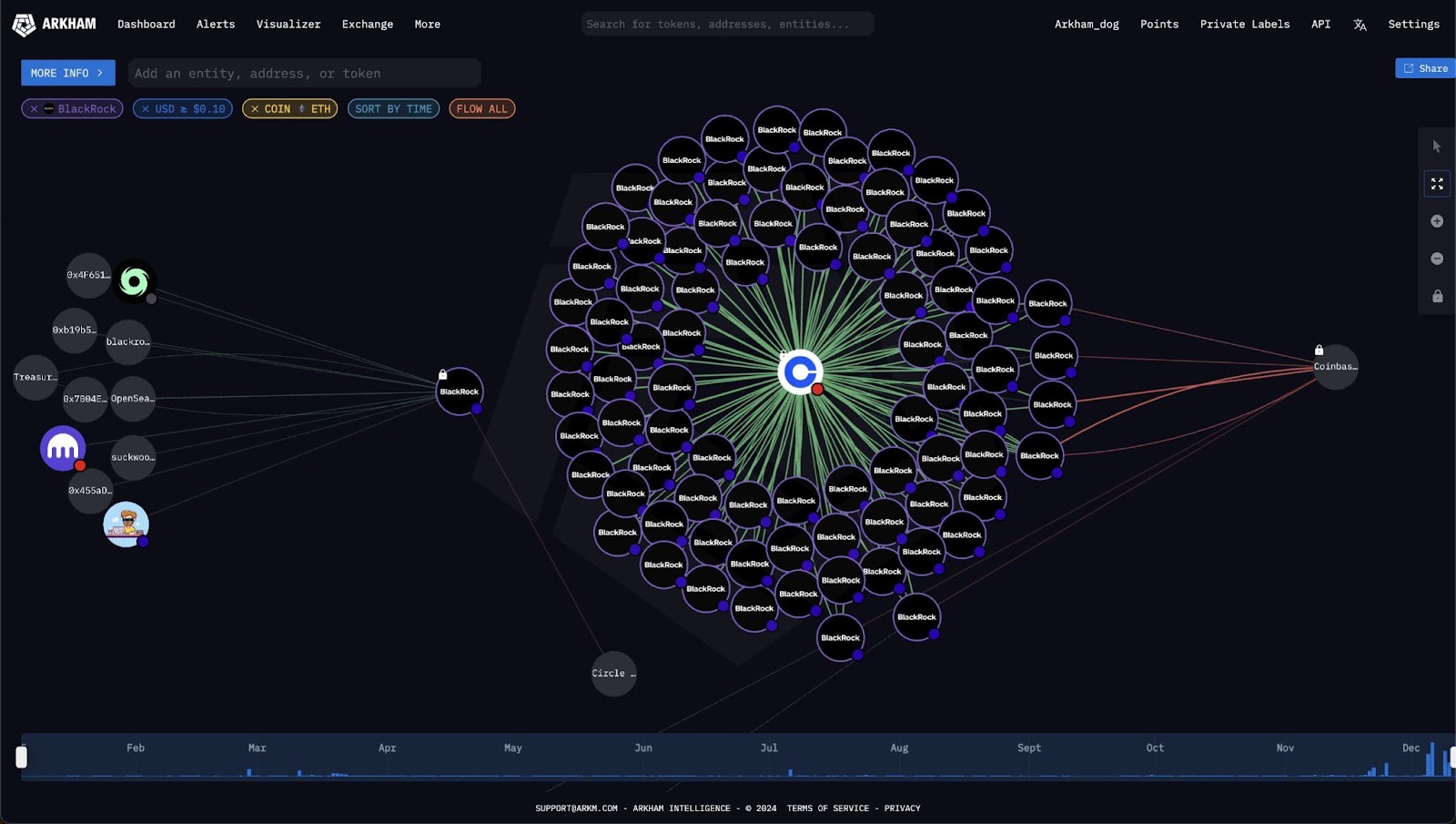

Ethereum continues to dominate institutional crypto investments. According to Arkham Intelligence, BlackRock and Fidelity bought $500 million worth of Ethereum in just two days, using Coinbase Prime to execute their trades. These purchases underline Ethereum’s increasing integration into traditional financial markets.

Source: The Block

BlackRock’s ETHA ETF Recorded an Explosive $372.4 Million in Trading Volume

BlackRock’s ETHA ETF ETH Investments in the last 48 Hours. Source: X

On December 10, BlackRock’s ETHA ETF recorded $372.4 million in trading volume. Fidelity’s FETH ETF added another $103.7 million on the same day. Together, these two ETFs generated $476.1 million in combined trading activity. Ethereum’s price rose to $3830 by December 11, marking a 5.1 percent increase in just 24 hours. During the same period, Ethereum's total trading volume reached $39.3 billion, showcasing strong market interest. These numbers signal the growing demand for Ethereum-focused financial products. Institutional investors are rapidly adopting Ethereum ETFs to gain exposure to the cryptocurrency, further legitimizing its position in global financial markets.

BlackRock’s ETHA ETF ETH Investments in the last 48 Hours. Source: X

SEC Approval Accelerates the institutional crypto adoption

The SEC's approval of eight spot Ethereum ETFs in May 2024 marked a major milestone for institutional crypto adoption. Spot ETFs allow investors to directly track Ethereum’s price without holding the asset themselves. Since the approval, institutional inflows into Ethereum have exceeded $3 billion, boosting liquidity and investor confidence.

Today, Ethereum ETFs manage $12 billion in total assets under management, reflecting the scale of interest from institutional players. These ETFs simplify the investment process for institutions, offering a regulated and accessible entry point into the cryptocurrency market.

Institutional Involvement Reshapes Ethereum’s Market

Fidelity’s FETH ETF ETH Investments in the last 48 Hours. Source: X

The $500 million investment by BlackRock and Fidelity represents a significant portion of recent trading activity. Ethereum’s market capitalization now exceeds $460 billion, solidifying its position as the second-largest cryptocurrency. Daily trading volumes regularly average $40 billion, with ETFs accounting for $4 billion of this activity.

Institutional participation brings more than just capital. It boosts market liquidity, stabilizes price movements, and builds trust among investors. BlackRock and Fidelity's actions show that Ethereum is not just a speculative asset but a viable component of diversified investment portfolios.

Fidelity’s FETH ETF ETH Investments in the last 48 Hours. Source: X

Ethereum’s Expanding Ecosystem

Ethereum drives innovation in the decentralized finance space. It currently secures $22 billion in total value locked across decentralized finance (DeFi) protocols. The network processes more than 1.1 million transactions daily, supporting thousands of decentralized applications and use cases.

Ethereum’s proof-of-stake consensus system adds another layer of security and efficiency. Over 74,000 validators actively maintain the blockchain, ensuring a decentralized and reliable network. Layer 2 scaling solutions built on Ethereum, such as Arbitrum and Optimism, hold over $9 billion in locked assets. These solutions enhance transaction speeds and reduce costs, making Ethereum more accessible to users.

Regulatory Support Brings Stability

The SEC's support for Ethereum ETFs represents a significant step in crypto regulation. Spot ETFs remove barriers for institutions by offering an easy and secure way to invest in Ethereum. They eliminate the need for private key management and provide the transparency that traditional investors demand. These features attract risk-averse institutions and enable them to deploy large amounts of capital confidently.

Since the launch of spot ETFs, Ethereum has seen a steady increase in adoption among institutional players. BlackRock and Fidelity’s activity reflects a broader trend of financial institutions embracing Ethereum as a core investment.

Read More: Ethereum ETF Explained: What It Is and How It Works

The Ripple Effect on Crypto Markets

Ethereum’s institutional adoption benefits the entire cryptocurrency ecosystem. As the second-largest blockchain, Ethereum sets the benchmark for trust and reliability. Its growing credibility among traditional financial players paves the way for broader adoption of digital assets. Ethereum’s success attracts more investors and developers, strengthening its ecosystem and driving innovation across the crypto market.

Conclusion

Ethereum’s rapid adoption by institutional players like BlackRock and Fidelity highlights its pivotal role in the evolving financial landscape. Their $500 million investment in just two days demonstrates the growing appeal of Ethereum ETFs as a bridge between traditional finance and crypto. With $12 billion in ETF assets under management, $3 billion in institutional inflows, and a thriving network, Ethereum continues to lead the way in both innovation and adoption.

Featured

Featured7m ago

Avalanche9000 Upgrade Set for Dec 16 Launch8m ago

Hedera's HUSD to Replace USDT in EU by Year-End8m ago

Bitcoin's Institutional Adoption May Hit $1M Price36m ago

Bitcoin Miners Earn $71.49B, Just 3.6% of $2T Market Cap37m ago

Lido DAO Eyes $3.50 Amid Bullish Momentum