Futures Plus

1. Introduction

Futures Plus is a high-yield, structured product for those with greater risk appetites. It offers potentially high returns with a degree of risk mitigation. It leverages market fluctuations in price for greater yields, and allows for early redemption to mitigate risks.

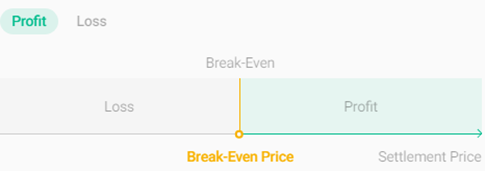

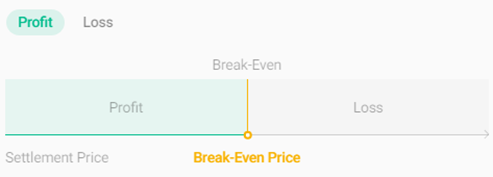

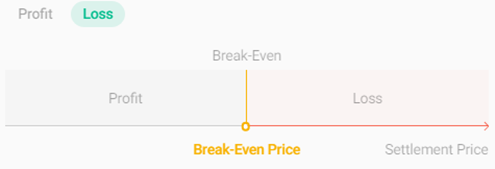

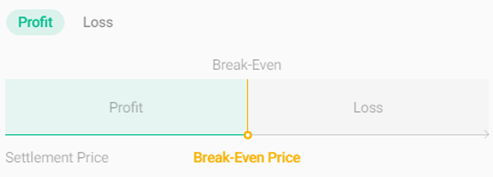

Long Futures Plus: If the price upon settlement is above the breakout price, the higher the percentage it exceeds by, the higher the profit. Conversely, losses increase if the price falls by more.

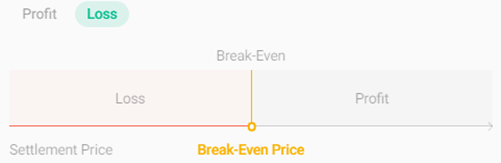

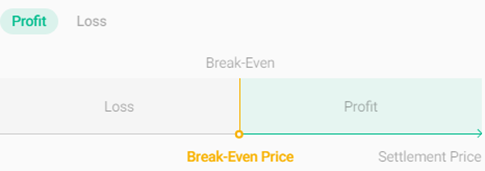

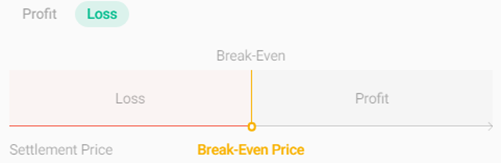

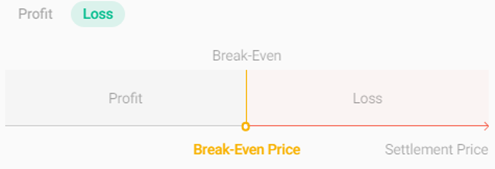

Short Futures Plus: If the price upon settlement is below the breakout price, the lower the percentage it falls by, the higher the profit. Conversely, losses increase if it the price increases by more.

Risk Warning: This product may result in the loss of all your principal. Please use with caution.

2. Settlement

USDT-Margined

Long Position:

(1) If settlement price above breakout price: Settlement Amount = Principal + Principal * Leverage Multiplier * (Settlement Price - Breakout Price) / Breakout Price

(2) If settlement price below breakout price: Settlement Amount = Principal - Principal * Leverage Multiplier * (Breakout Price - Settlement Price) / Breakout Price

The minimum settlement amount is 0, representing a total loss of principal.

Short Position:

(1) If settlement price below breakout price: Settlement Amount = Principal + Principal * Leverage Multiplier * (Breakout Price - Settlement Price) / Breakout Price

(2) If settlement price above breakout price: Settlement Amount = Principal - Principal * Leverage Multiplier * (Settlement Price - Breakout Price) / Breakout Price

The minimum settlement amount is 0, representing a total loss of principal.

Coin-Margined

Long Position:

(1) If settlement price above breakout price: Settlement Amount = Principal + Principal * Leverage Multiplier * (Settlement Price - Breakout Price) / Settlement Price

(2) If settlement price below breakout price: Settlement Amount = Principal + Principal * Leverage Multiplier * (Breakout Price - Settlement Price) / Settlement Price

The minimum settlement amount is 0, representing a total loss of principal.

Short Position:

(1) If settlement price below breakout price: Settlement Amount = Principal + Principal * Leverage Multiplier * (Breakout Price - Settlement Price) / Settlement Price

(2) If settlement price above breakout price: Settlement Amount = Principal - Principal * Leverage Multiplier * (Settlement Price - Breakout Price) / Settlement Price

The minimum settlement amount is 0, representing a total loss of principal.

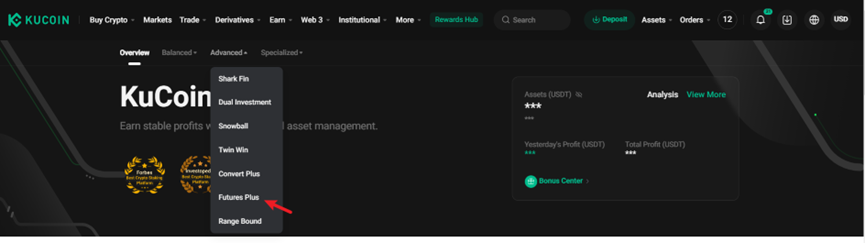

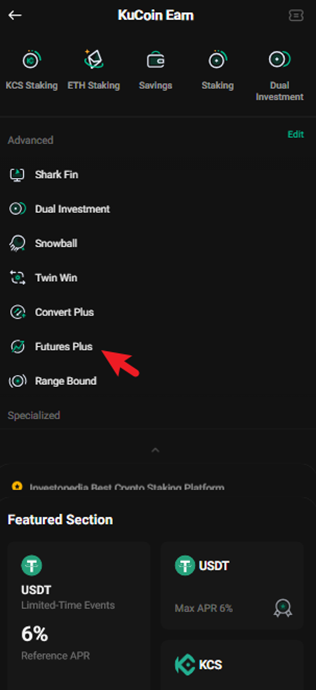

3. How to Subscribe

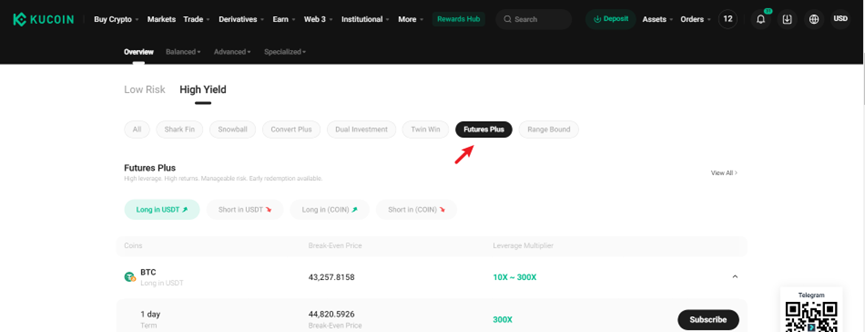

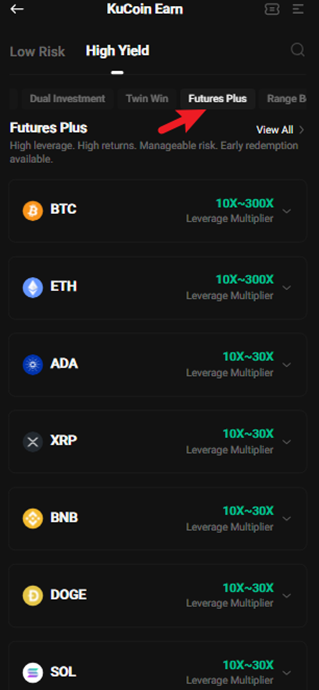

Method 1: From the KuCoin Earn page, select Futures Plus. Select your target currency, subscription currency, desired APR, and any other parameters. Finally, select Subscribe to proceed to the confirmation page.

Method 2: From the KuCoin Earn page, select Futures Plus from the product list.

4. How do I view my subscribed Futures Plus products?

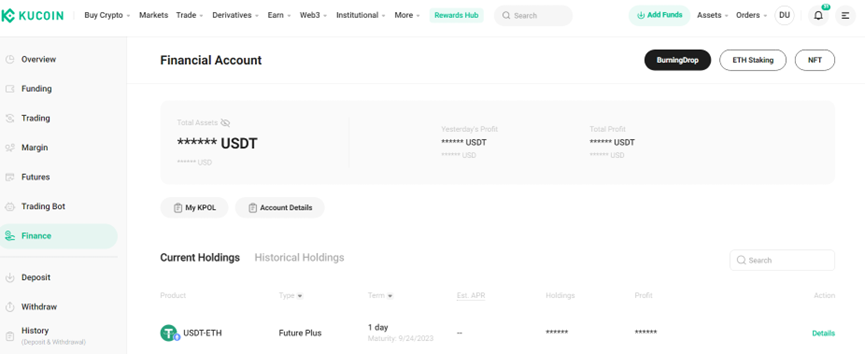

Web:

Access the Financial Account through the top navigation bar to view the products you’ve subscribed to. Under Details, you’ll be able to check the status of any purchased products.

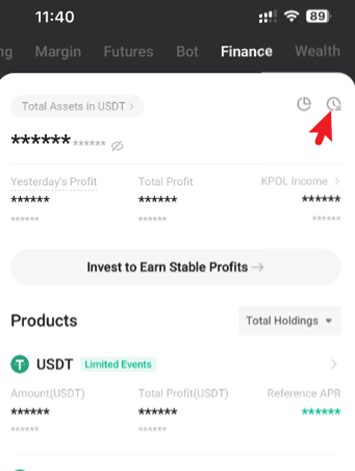

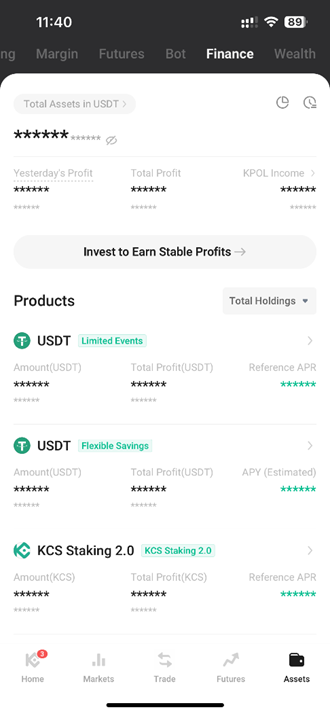

App:

Access your Financial Account through the Account icon at the bottom of the app, and tap to view the products you’ve subscribed to. Select the subscribed products to check their statuses.

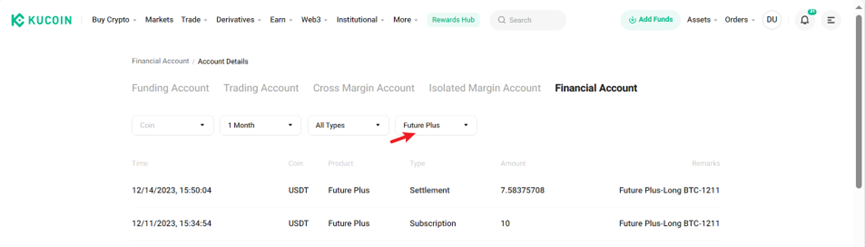

5. Where can I see the settlement amounts of my Futures Plus products?

Web:

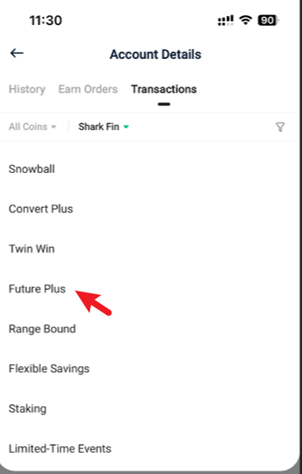

Access your Financial Account from the top navigation bar, select Account Details, filter by product type, and look for your Futures Plus transaction details.

App:

Access your Financial Account from the Account icon at the bottom of the app, select Account Details in the top right, and look for your Futures Plus transaction details.