Getting Started with Futures Grid: Beginners Tutorial

1. What is Futures Grid?

Futures Grid implies the action where one can apply the strategies of Grid Trading to Futures Trading and choose a direction of short selling or long buying.

If you go long according to the price range set by the grid, the number of grids and other parameters you can buy is more when the price falls, and you can sell more when the price rises. Therefore you can obtain deterministic grid profits by a high throw bargain - hunting. In the same way, if you go short, you will also open the short at the high price and close the short at the low price.

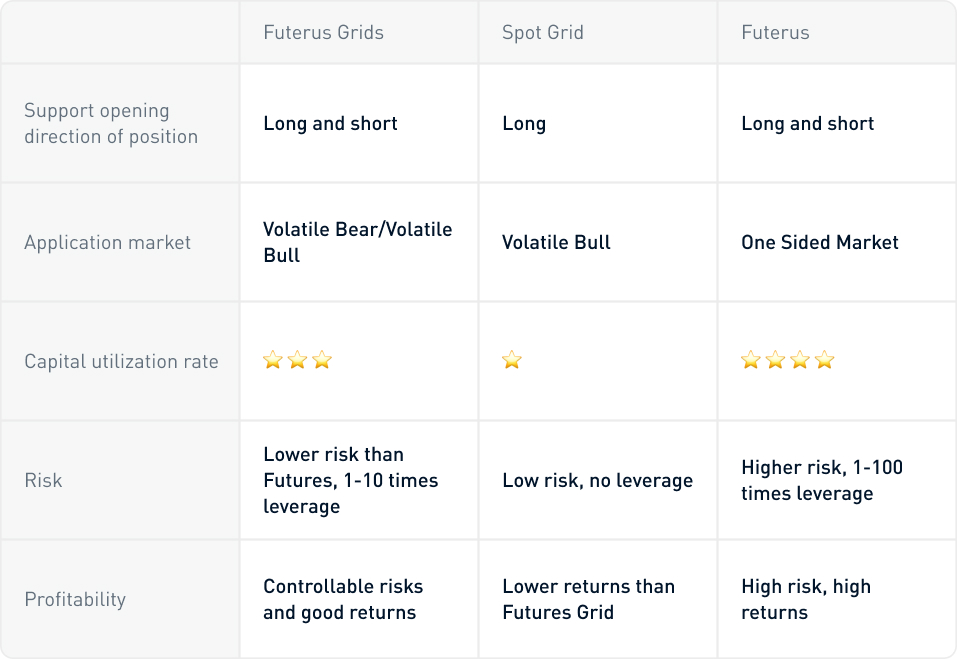

2. Futures Grid vs. Spot Grid vs. Futures

Which is best for you?

3. What are the benefits of Futures Grid?

(1)The passive position management of the Futures Grid makes its risk smaller than that of Futures trading.

The initial position opening may only be about 50%, which avoids the high risk of Futures trading when the position is full. If there is a loss, the Futures Grid will have a smaller loss than the Futures trade.

(2)Forced de-leveraging.

KuCoin Futures Grid leverage is adjustable from 1-10 times, and liquidating is more difficult under the same conditions. Under the condition of controllable risks, considerable returns can be achieved.

4. If there is a loss, what might have caused it?

The opening direction of the Futures Grid is wrong, and there is a floating loss.

In the volatile market, the holding time is too short, and the grid is stopped in advance before reaching the profitable position.

The grid parameters are not set properly, the price spacing is too small, the grid is too dense, and the profit is worn by the cost.

Risk Warning: Grid trading as a strategic trading tool should not be regarded as financial or investment advice from KuCoin. Grid trading is used at your discretion and at your own risk. It is recommended that users should read and fully understand the Grid Trading Tutorial and make risk control and rational trading within their financial ability.