Understanding Auto-Borrow and Auto-Repay Functions in Margin Trading

| Auto-Borrow | Auto-Repay | |

| Purpose |

The Auto-Borrow system automatically borrows the required currency and amount for you, eliminating the need for manual borrowing. This saves precious time and makes margin trading even faster and simpler. |

The Auto-Repay feature helps you promptly repay your liabilities, reducing outstanding debts and decreasing the debt ratio. |

| Requirements for Activation |

In the trading interface, select Auto-Borrow for order modes. When trading, the required currency and amount will be borrowed automatically. |

In the trading interface, select the Auto-Repay mode for placing orders. Whenever an order is fully executed, if you have a liability in the acquired currency, the repayment process will automatically take place for you. |

| Features |

1. Can be enabled whenever you place an order. 2. Minimizes the need for manual borrowing, saving time and enabling quick trades. 3. When using Auto-Borrow for orders, assets required for completing the trade will be automatically borrowed, regardless of whether it involves opening and closing positions, buying, or selling. 4. We recommend also enabling Auto-Repay when placing sell orders. |

1. Can be enabled whenever you place an order. 2. Reduces the need for manual repayments, thus saving time and reducing the amount of interest that needs to be paid. 3. With Auto-Repay enabled for orders, your repayment will automatically occur after the order is executed. 4. After confirming your long or short position for the currency, select the corresponding buy or sell direction and enable Auto-Repay. |

| If A Function Doesn't Work |

1. There isn't enough supply of the specific currency in the lending market, or there are no existing orders for it on the market. 2. The currency has been delisted from the lending market. |

/ |

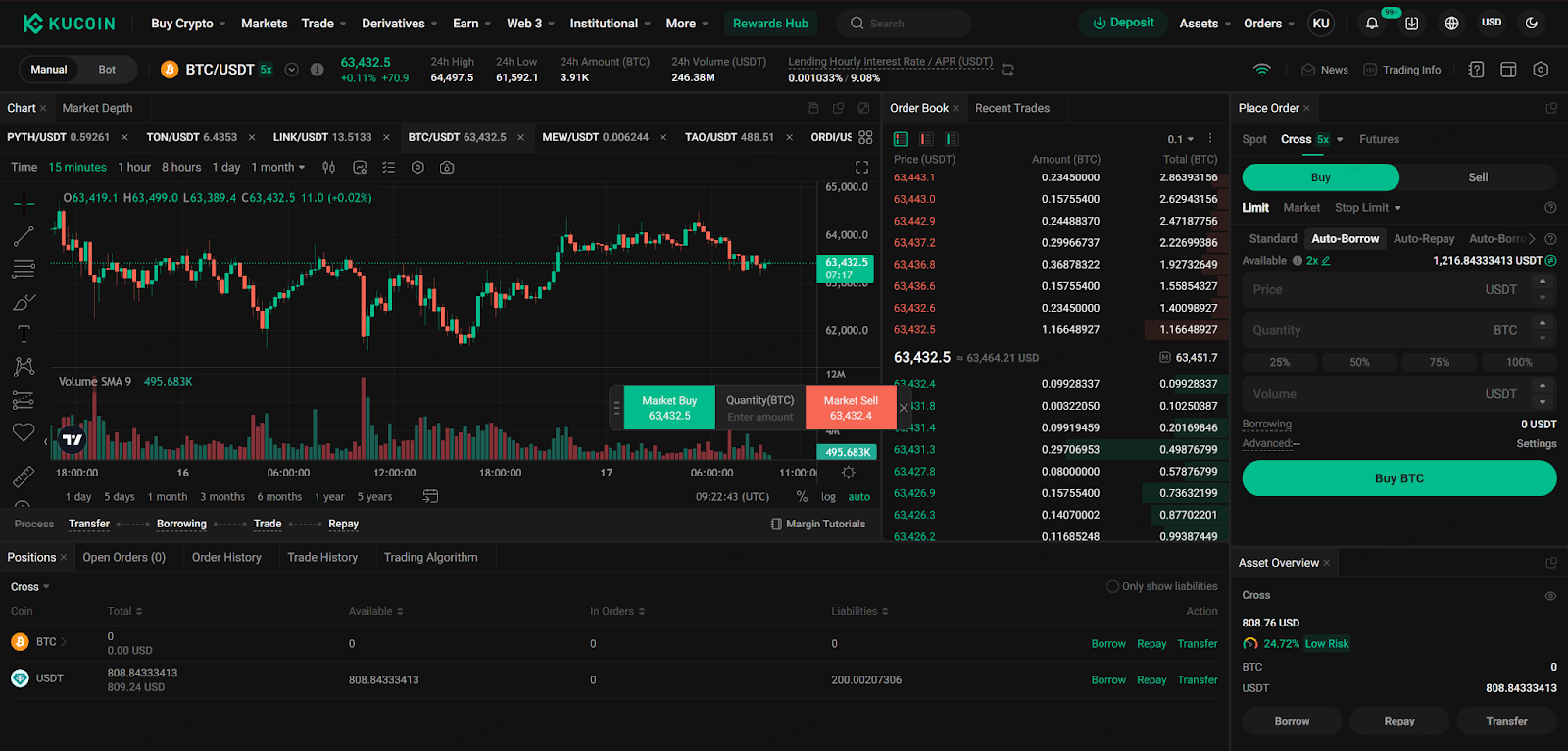

Auto-Borrow and Auto-Repay on KuCoin Web

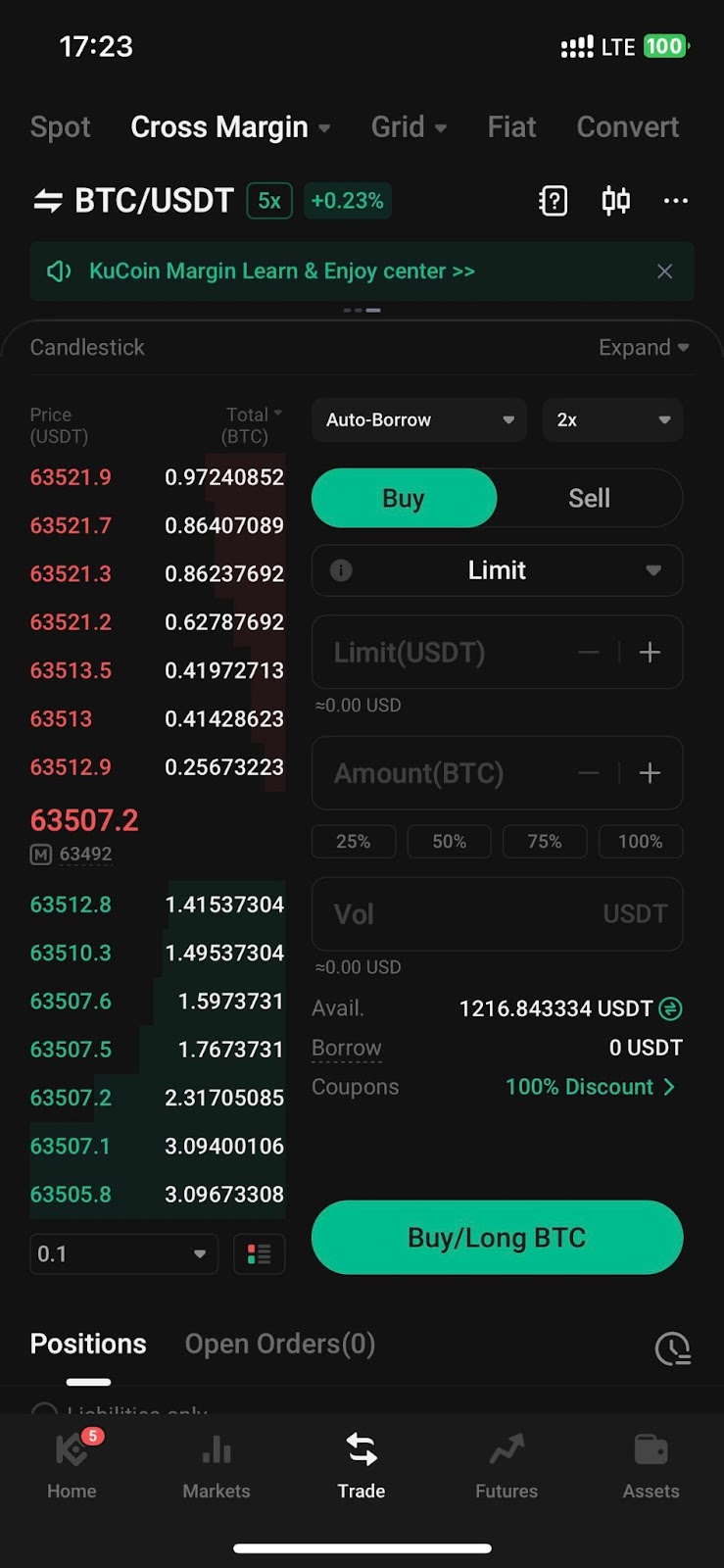

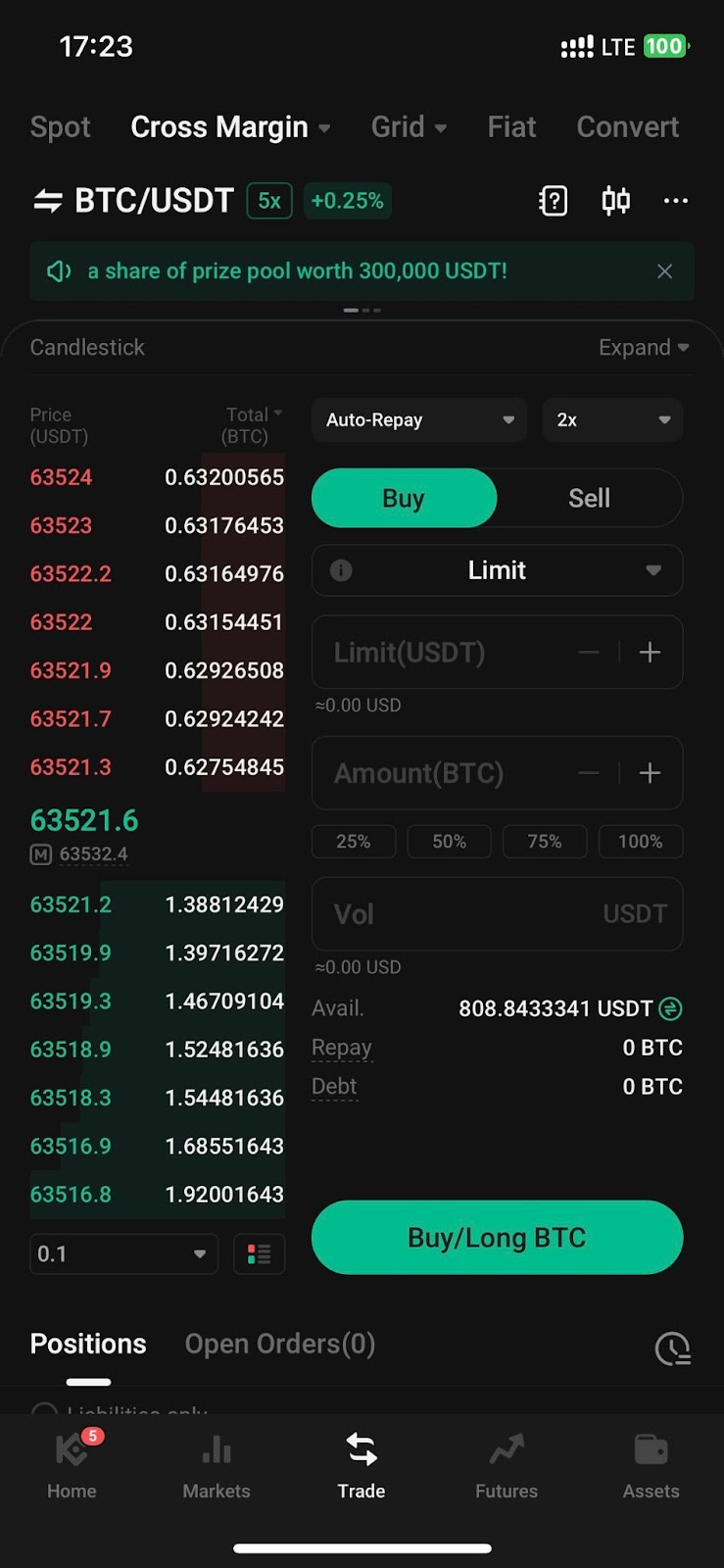

Auto-Borrow and Auto-Repay on KuCoin App

FAQs on Auto-Borrow and Auto-Repay

Q1: I conducted a single margin trade but did not borrow any assets. Why do I have a debt ratio? Furthermore, why is the debt ratio so high?

You may have used the Auto-Borrow function when trading. We recommend checking your margin assets and borrowing history. Make sure to confirm the correct order placement mode when conducting future trades.

Q2: I conducted a single margin trade. Why did the assets in my margin account decrease while my debt ratio also reduced?

You may have enabled the Auto-Repay function when trading. For future trades, please confirm the correct order placement mode. We also recommend checking your repayment history.

Q3: I originally intended to close my position and repay the related liabilities. Why did I end up borrowing again when trading?

You might have previously enabled the Auto-Borrow feature and forgotten to disable it. Once Auto-Borrow is enabled, it remains active and will automatically borrow for all future trades. We recommend disabling this feature when it's not needed and enabling it when necessary.