資金費率教學

資金費率是永續合約市場的一個獨特特徵,作為一種機制來最小化永續合約與相應現貨市場之間的價格差距。其計算與持倉價值相關,並影響倉位盈虧甚至強制平倉價格。以下提供進一步的解釋。

1.資金費用結算機制

與交割合約不同,永續合約不需要交割。用戶在到期時不需要結算或清算,可以長期持有。然而,沒有結算的情況下,需要一個機制來使合約價格與現貨價格保持一致。這就是我們所稱的「資金費用機制」。簡而言之,永續合約使用這個機制將合約價格與現貨價格掛鉤。

資金費用在多頭和空頭之間支付。正的或負的資金費率決定了多頭或空頭持倉誰支付費用。費用完全在用戶之間結算,平台不收取任何費用。當資金費用為正時,多頭(押注價格上漲的)將支付資金費用,而空頭(押注價格下跌的)將收到資金費用。當資金費率為負時,情況正好相反。

2.資金費用結算對倉位盈虧和強制平倉的影響

1.原則:

1.1 對倉位盈虧的影響

在資金費用結算時,可能會發生兩種情況:

用戶A支付資金費用,導致持倉虧損;

用戶B收到資金費用,導致持倉盈利。

這意味著資金費用的結算直接影響倉位盈虧。當用戶需要支付資金費用時,他們的持倉將會遭受損失。

1.2 對強制平倉的影響

如前所述,支付資金費用可能導致持倉損失和減少倉位保證金。當保證金低於維持保證金時,將觸發強制平倉。因此,雖然資金費用結算不會直接導致強制平倉,但它會影響倉位保證金。

請注意,持續支付資金費用可能導致您的持倉保證金低於維持保證金,從而導致強制平倉。

2.計算:

資金費用 = 持倉價值 * 資金費率

持倉價值由資金費率結算時的標記價格決定。

範例:

對於BTC/USDT 永續合約,用戶A持有0.01 BTC的多頭持倉,標記價格為$5,000,資金費率在資金費率結算時為0.01%。然後:

持倉價值 = 0.01 * 5,000 = 50 USDT

資金費用 = 50 * 0.01% = 0.005 USDT

當資金費率為正時,多頭持倉支付給空頭持倉。用戶A將支付0.0005 USDT的資金費用,而用戶B持有相同數量的空頭持倉,將收到0.0005 USDT的資金費用。

注意:在反向合約中,持倉價值 = 1 / 標記價格 x 數量。

3.如何控制持倉風險:

資金費用的結算與持倉價值相關,並呈正相關。持倉價值越大,支付或收到的資金費用越多。如果您持有大量持倉,建議更加注意資金費用結算對您持倉的影響。

提示:

1.避免資金費用結算時間,並儘量提前平倉。

資金支付的結算頻率為每八小時一次,開始於00:00 (UTC)、08:00 (UTC)和16:00 (UTC)。資金支付的結算頻率為每四小時一次,開始於00:00 (UTC)、04:00 (UTC)、08:00 (UTC)、12:00 (UTC)、16:00 (UTC)和20:00 (UTC) 資金費用支付的具體時間可能會有最多20秒的變化。 只有在結算時持有持倉的用戶需要支付或接收資金費用。如果在結算之前平倉,則無需支付或收取資金費用。

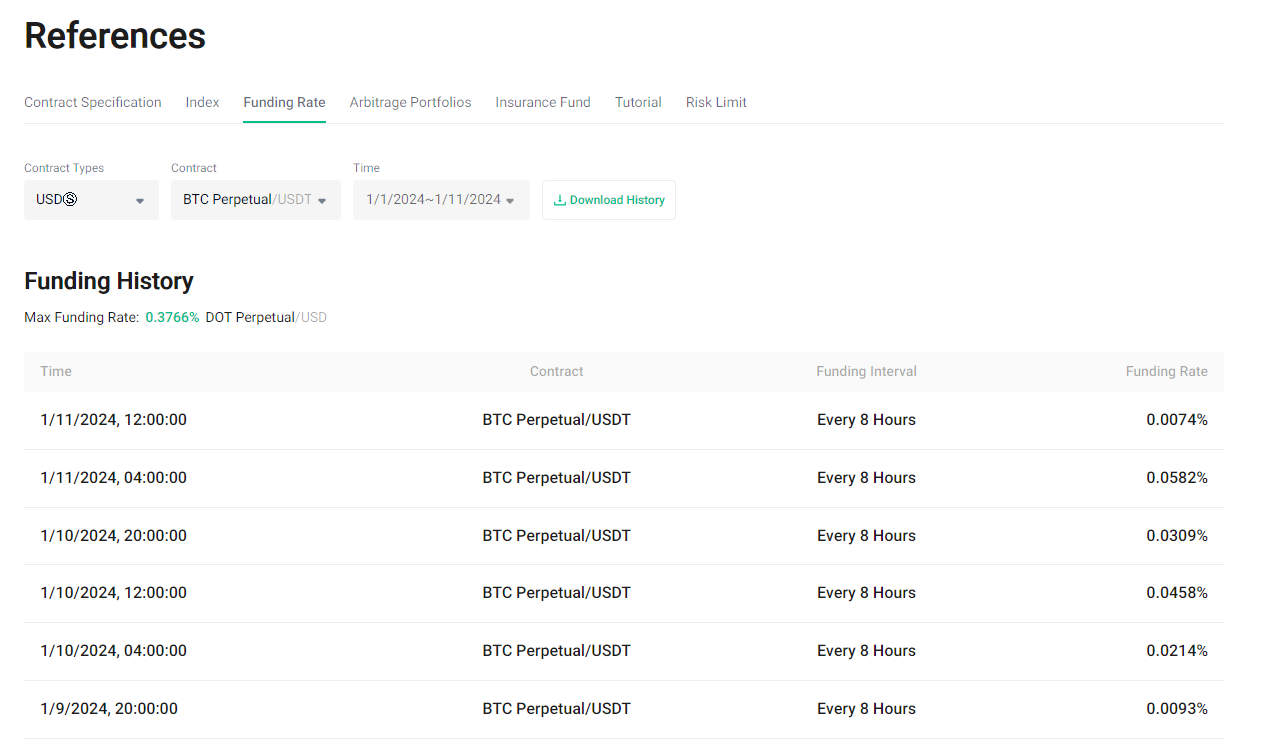

KuCoin支持查看每個合約的資金費率歷史。有關詳情,請按此。

2.建議避免使用高槓桿下單。

建議初學者使用最多5倍的槓桿,以保持持倉風險在合理範圍內。

3.如何利用資金費用機制進行穩定套利?

除了支付資金費用外,還可以接收資金費用。那麼,如何持續接收資金費用以進行穩定套利呢?答案是資金費率套利策略,可以用來獲得低風險和長期回報。這也允許多元化投資和對沖,即使在低波幅市場中也能獲利。

換句話說,您可以通過在不同交易市場同時開設永續合約的空頭持倉和幣幣交易/槓桿交易/交割合約的多頭持倉來實施資金費率套利。常見的套利策略包括將永續合約與幣幣交易/槓桿交易結合,或將永續合約與交割合約結合。有關具體套利操作的進一步細節將在後續文章中介紹。

在考慮如永續合約與現貨市場之間的基本套利或多平台合約方法等策略時,利用資金費率的雙重優勢是關鍵。每種交易策略都帶有風險,因此選擇與您的偏好相符的策略、建立自己的投資規則並有效控制風險至關重要。

KuCoin 合約指南:

感謝您的支持!

KuCoin 合約團隊

注意:受限國家和地區的用戶無法開通合約交易。