Weekly Crypto Analysis: Market Cap Stays Above $1 Trillion Despite Series of Hacks, FLOW Pumps 40%

Most of the cryptocurrencies traded sideways as the global crypto market cap was $1.09 trillion, down 1.33% from yesterday. The overall cryptocurrency market volume in the past 24 hours was $44.71 billion, a 35.18% drop. The entire volume in DeFi came up to $5.00 billion, accounting for 11.15% of the overall 24-hour volume in the crypto market. The overall volume of all stable currencies is currently $40.58 billion, accounting for 90.75% of the entire 24-hour volume of the crypto market.

A slight slowdown in the cryptocurrency market can be associated with a stronger US dollar amid a series of fundamentals. A stronger-than-expected US jobs report Friday dominated the end-of-week market price activity; whether they continue or reverse this week largely depends on Wednesday's US July CPI statistics.

The dollar maintained steady as US nonfarm payroll data pushed back against predictions of a recession while simultaneously bolstering the argument for further massive rate hikes. Markets swiftly priced in a 70% likelihood of the Fed raising rates by 75 basis points in September, driving two-year yields up 20 basis points.

The labor department reported a 528k boost in US payrolls in July, which was more than double the 250k projected, was accompanied by a net 28k upward revision to the combined May/June figures. Moreover, the decline in the unemployment rate from 3.6% to 3.5% also underpinned the demand for the greenback. With a stronger NFP, dollar-denominated cryptocurrency pairs are under pressure as investors' attention shifts to the US dollar. However, this has already been factored in, and the market may return to volatile cryptocurrencies.

Let's delve deeper and take a quick look at the latest crypto market news and FLOW's technical outlook.

Crypto Market Overview

Bitcoin's dominance is steadily declining and now stands at 41.30%; however, BTC‘s price has risen 1.03% in the last seven days. The most valuable cryptocurrency pair, BTC/USD, is currently trading at $23,596.79, while Ethereum, the second-largest cryptocurrency by market capitalization, has risen to $1,729.36, up 2.59% in the last week.

The top performers from the previous week were Flow (FLOW), Decred (DCR), and Trust Wallet Token (TWT). FLOW has increased by more than 40% to $2.98, while TWT has increased by 37.63% in the last seven days to $37.36. Finally, the Trust Wallet Token (TWT) gained 25.34% to $1.18.

Cryptocurrency Market Heatmap | Source: Coin360

On the other hand, Filecoin (FIL), BitTorrent-New (BTT), and EOS (EOS) were the worst performers of the week, but their losses were minor. FIL is down 10.54% to $9.21; BTT is down 6.87% in the last seven days; EOS is down 6.51% to $1.26.

During the last week, the crypto market experienced a risk-off sentiment as investors sought safe-haven assets in the aftermath of a series of hacks and a stronger US dollar. However, the market has already priced in these updates, and risk-on sentiment may prevail this week. So, let us delve a little deeper to discover what is causing market volatility.

Top Altcoin Gainers and Losers

Top Altcoin Gainers:

⧫ Flow (FLOW) ➠ 40%

⧫ Decred (DCR) ➠ 37.63%

⧫ Trust Wallet Token (TWT) ➠ 25.34%

Top Altcoin Losers:

⧫ Filecoin (FIL) ➠ 10.54%

⧫ BitTorrent-New (BTT) ➠ 6.87%

⧫ EOS (EOS) ➠ 6.51%

News Highlights

Here are some of the events that made the previous week's crypto news section stand out:

Ethereum 2.0 Merge in the Limelight, Keeping Ether Above $1,700

The second leading cryptocurrency, Ether, is trading above the $1,700 mark amid merger speculation. Only a few more tests are left before the Merge to ensure that Ethereum's proof-of-work (PoW) protocol seamlessly transitions to its beacon proof-of-stake (PoS) network. Goerli, the most anticipated event for the Ethereum merger, is at its third and final test network environment.

Goerli is expected to switch to PoS before August 12. This may vary depending on how fast the hashrate operates. Although the September Merge has received much attention, this final test will determine how things play out on the Ethereum mainnet.

Even though this will be the final testnet before the official Merge, Ethereum developers will continue to test smaller devnets and shadow forks. Unfortunately, the Ethereum Merge has frequently been postponed to improve the procedure rather than hasten the transition.

This strategy has enabled developers to upgrade nodes and test node functionality securely. We can expect the mainnet Merge to happen soon, assuming no problems arise during the Goerli-Prater Merge. The Ethereum Merge developments are driving a bullish trend not only for ETH but also for the overall cryptocurrency market.

Another thing to note is that there have been rumors of a community of Ethereum’s PoW supporters being active, with the most prominent member being Tron’s Just Sun. If this community grows large enough, we may see both a PoW and a PoS Ethereum version staying alive, and being managed by different dev and management teams.

Michael Saylor, CEO of MicroStrategy, Steps Down to Focus on Bitcoin

Michael Saylor, the CEO of publicly traded business intelligence company MicroStrategy, announced his resignation on August 2. Saylor has been a vocal and enthusiastic supporter of bitcoin for many years. Under his supervision and guidance, MicroStrategy has spent nearly $3 billion to purchase 129,699 Bitcoin since 2020.

As a result of its Bitcoin buying spree, the company eventually became the sole largest publicly traded owner of that cryptocurrency asset. Saylor will now serve as executive chairman and will focus on cryptocurrency and Bitcoin activities, according to the official letter. He claimed to be concentrating his efforts on the acquisition of Bitcoin and other cryptocurrency-related projects.

Saylor's overemphasis on Bitcoin has harmed MicroStrategy's balance sheet, which is unfortunate. According to its corporate press release and regulatory filings, MicroStrategy lost $917.8 million to its leading digital asset holding, Bitcoin. The asset loss is largely due to a 60% drop in the price of that cryptocurrency from its all-time high of nearly $69,000 per coin in November last year.

Crypto Bridge Nomad Recovers $22 Million

During the last week, Nomad Cryptocurrency Bridge was the victim of a chaotic attack, which caused the project to lose value among many users. Hackers stole over $190 million from the blockchain network by exploiting an update error.

However, according to Etherscan statistics, the Nomad recovery fund received $22 million in ETH, DAI, USDC, USDT, CQT, FRAX, WBTC, and wETH on August 5th. Several "white hat" hackers carried out a bridge raid to return the money to the Nomad team.

Instead of taking part in the impending free-for-all, these white hat hackers attempted to defend Nomad cash. Such events hurt the cryptocurrency market and contribute to bearish sentiment.

Thousands of Solana Wallets Hacked, SOL Slipped 2.30%

The Solana ecosystem appears to be the next victim of cryptocurrency's current hack, with users reporting that funds are being withdrawn from major internet-connected wallets without their knowledge. On the evening of August 2, several users began to claim that their hot wallets, which are internet-connected addresses such as Phantom, Slope, and Trust Wallet, had drained their funds.

The exact reason for the attack is still unknown, but the vast majority of those affected use mobile wallets. The fact that the attacker signs, initiate, and authorizes transactions on behalf of users suggests that the Hacker may have hacked a trustworthy third-party service in a supply chain attack.

However, according to blockchain auditors OtterSec, the hack is still active, affecting over 8,000 wallets and many Solana addresses. Furthermore, those wallets amassed SOL, SPL, and other Solana-based tokens worth at least $5 million from unsuspecting clients.

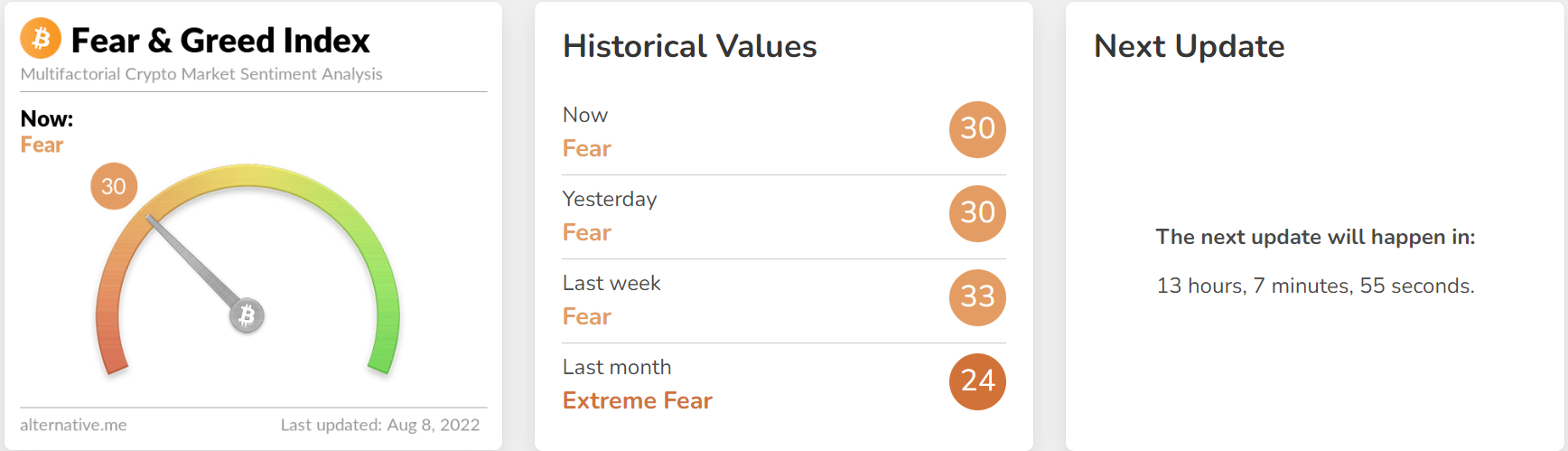

The Fear & Greed Index Is 30, Signaling “Fear”- Risk-off Sentiment in Play

The fear and greed index signals "fear," with an index indicating a 30 score. Fear levels have remained unchanged from yesterday.

Last month, the index scored 24, indicating extreme market fear. Since the index shifted from "extreme fear" to "fear," the market has been trading with the risk-on sentiment. Perhaps this is one of the reasons for the bullish trend in the cryptocurrency market.

Fear & Greed Index | Source: Alternative

Crypto Calendar: Events to Watch This Week

➺ 09/08/2022 - HBAR - Mainnet Upgrade V0.27.x

➺ 09/08/2022 - 5IRE - Blockchain Futurist Conf

➺ 11/08/2022 - ETH - Goerli Merge

➺ 11/08/2022 - NEAR - NFT Discussion with ASAC

➺ 13/08/2022 - XMR - Network Upgrade

Flow (FLOW/USDT) Analysis on KuCoin Chart

Flow is trading sharply higher at $3.05, having completed a Fibonacci retracement of 61.8% at $2.60. FLOW/USDT has formed a bullish engulfing candle on the 4-hour timeframe, indicating an uptrend, and it is now approaching the $3.01 resistance level. A break above the $3.01 resistance level exposes the FLOW price to the $3.33 major resistance level. Whereas, further on the higher side, FLOW has resistance at $3.80.

FLOW/USDT Chart on the Daily Timeframe | Source: KuCoin

On the downside, FLOW’s immediate support is $2.80 per coin. If FLOW falls below this level, it will be vulnerable to the next support levels of $2.60 and $2.34. Technical indicators like the RSI (relative strength index) and MACD (moving average convergence divergence) point to an uptrend. Furthermore, the 50-day EMA (exponential moving average) is holding at $2.200, supporting the bullish trend in FLOW.

Did you know that KuCoin offers premium TradingView charts to all its clients? With this, you can step up your Bitcoin technical analysis and easily identify various crypto chart patterns.