KuCoin Futures New User Guide

KuCoin Futures Pro is a comprehensive cryptocurrency derivative trading platform and offers various popular leveraged crypto contract products with high-level security.

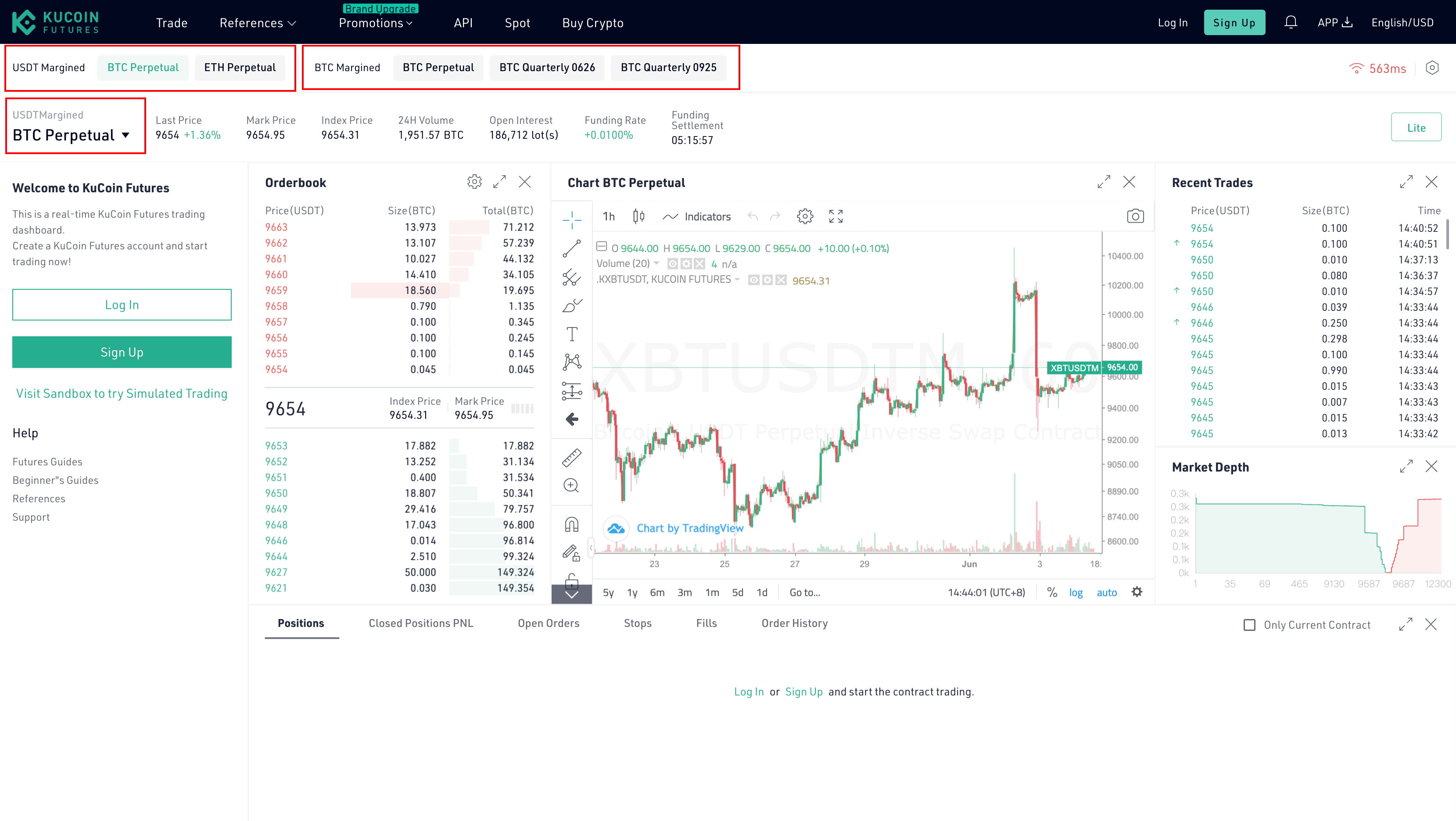

Trading Market: USDT-Margined Contracts and BTC-Margined Contracts

The USDT-Margined contract takes USDT as margin to exchange bitcoin or other popular contracts; while for BTC-Margined contract, it takes BTC as margin to exchange bitcoin contracts.

On KuCoin Futures Pro, you can freely switch between the USDT-margined contract and BTC-margined contract:

For contracts in the USDT-margined market, they are settled in USDT and for contracts in BTC-margined market, they are settled in BTC.

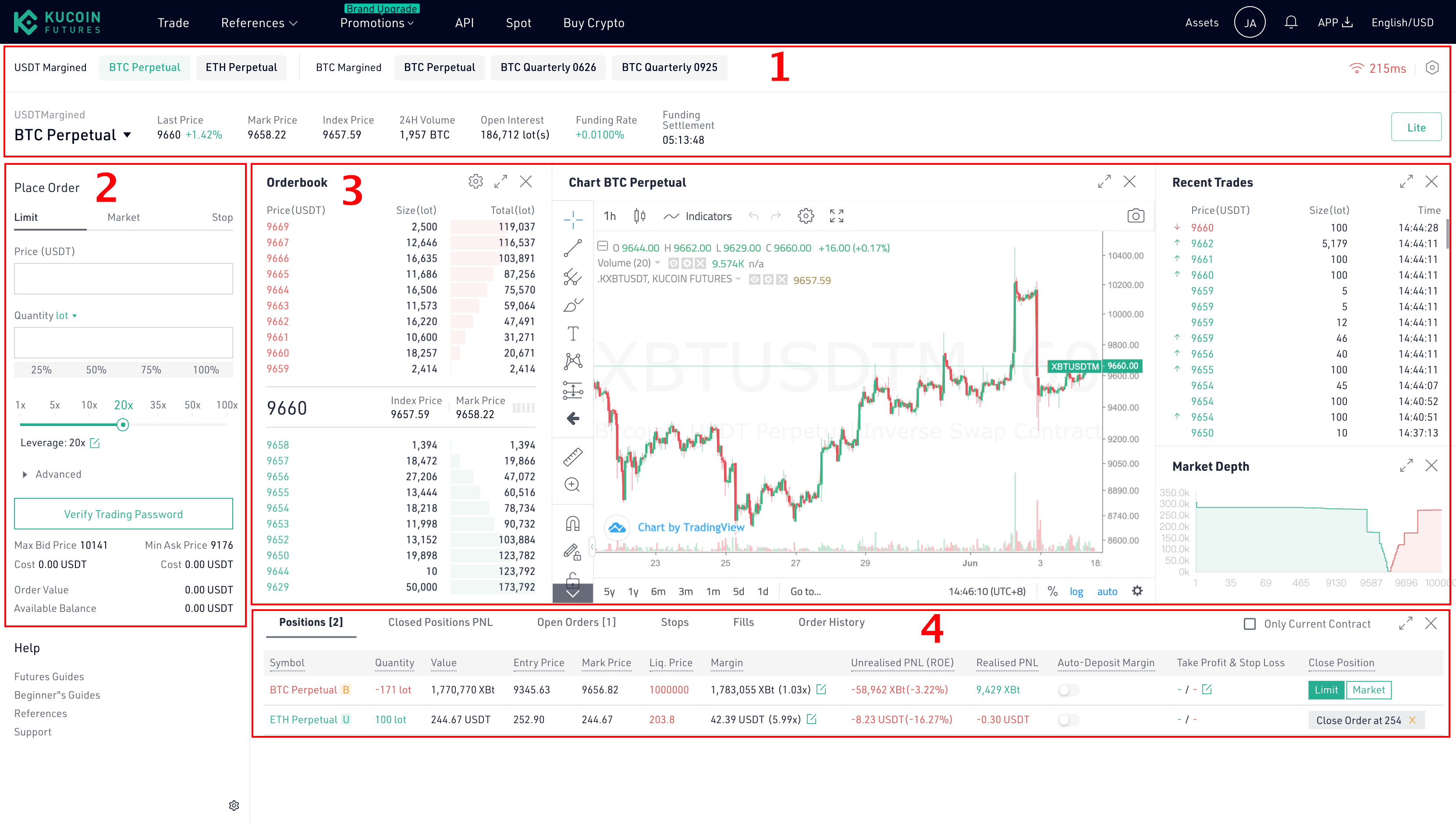

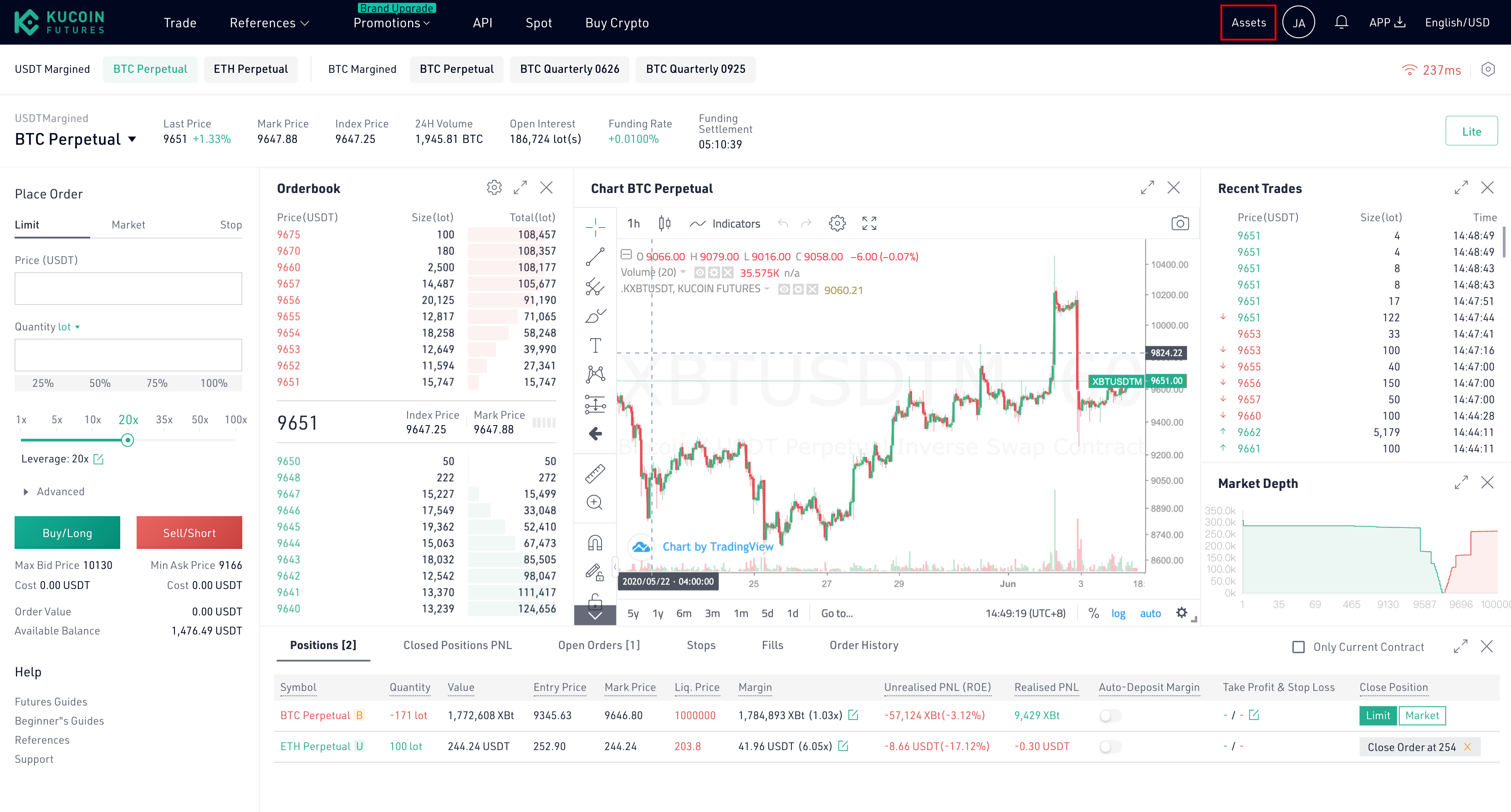

Layout Overview

1. Contracts: On KuCoin Futures Pro, you can freely switch among the markets and contracts and check changes over the last price/change/trading volume, etc.

2. Trade: You’re available to open, close, long, or short your positions by placing orders in the order placing area.

3. Market: KuCoin Futures Pro has also offered a candlestick chart, market chart as well as the recent trade list and order book on the trading interface to display the market changes for you in full dimension.

4. Positions: In the position area, you can check your open positions and order status by just a simple click.

Trade

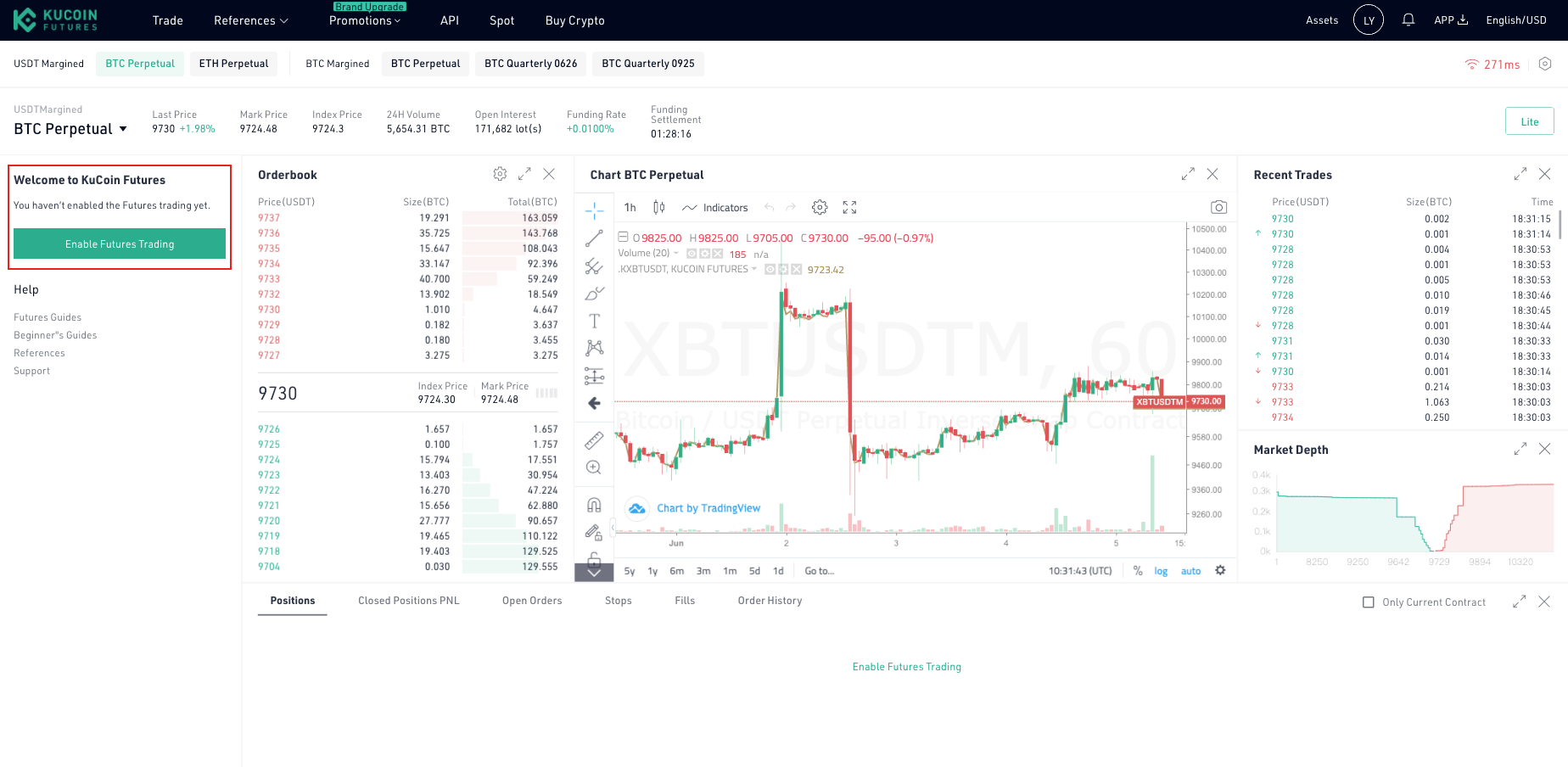

1. Enable Contract Trading

To enable contract trading, please click the button “EnabLog In & Sign Up"

Log In: If you've already had a KuCoin account, you can log in directly to start the contract trading.

Sign Up: If you do not have a KuCoin account, please click “Sign Up ” for registration. (How to Sign Up on KuCoin? )

2.Enable Contract Trading

To enable contract trading, please click the button “Enable Contract Trading” and tick “I Have Read and Agree” to proceed with the operation.

3. Set Trading Password

To ensure the security of your account and assets, please complete the setting and verification of your trading password.

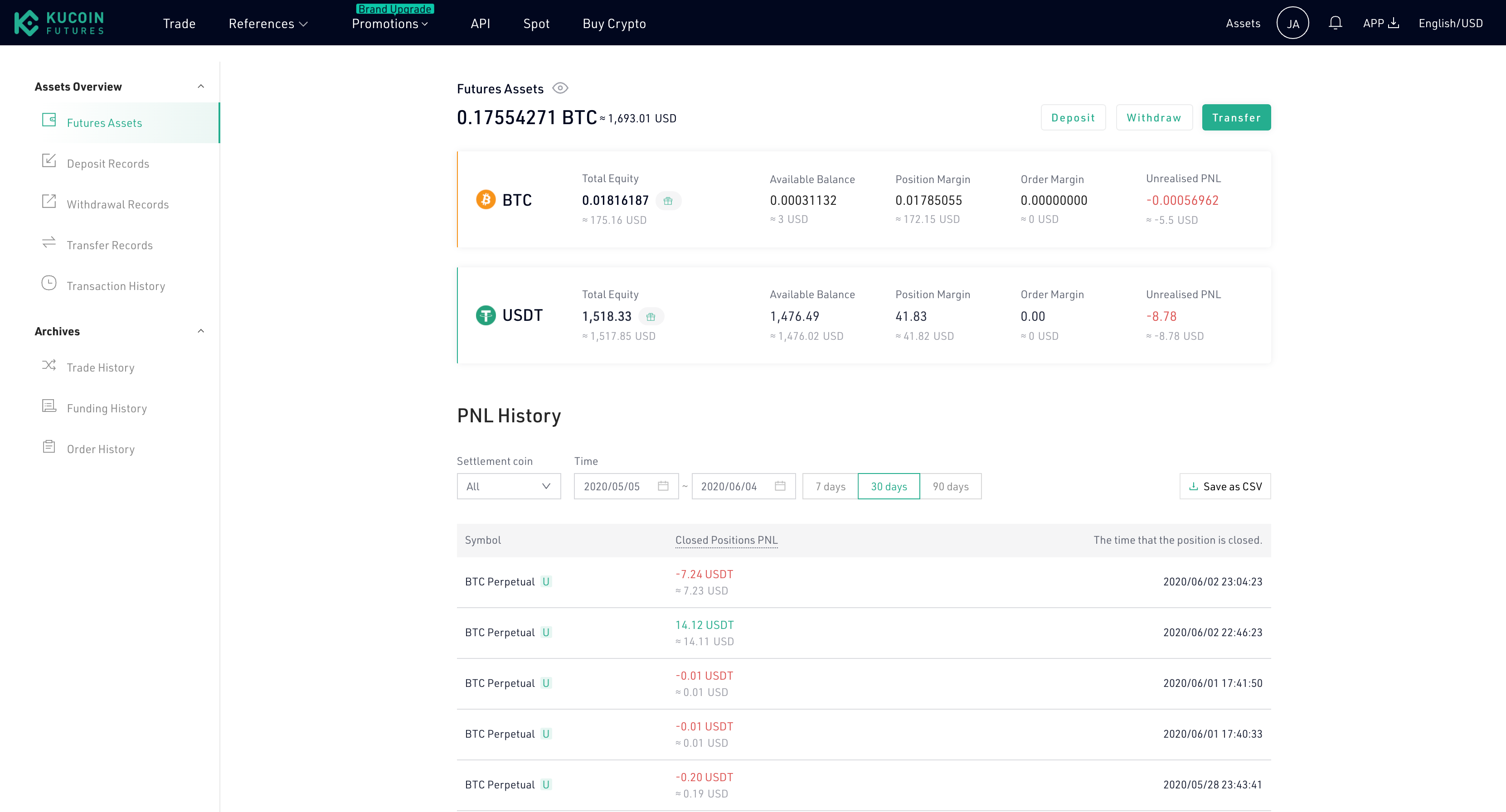

4. Contract Assets

To check your assets on KuCoin Futures Pro, click “Total Equity” or “Available Balance” on the top right corner of the page and you will be redirected to the assets page.

In the assets page, you can check your total assets, the weighted BTC and USDT equity, available balance, position margin, order margin, unrealised pnl and the pnl history in your account. In the “Pnl History” part, you can check the historical profit and loss of your positions.

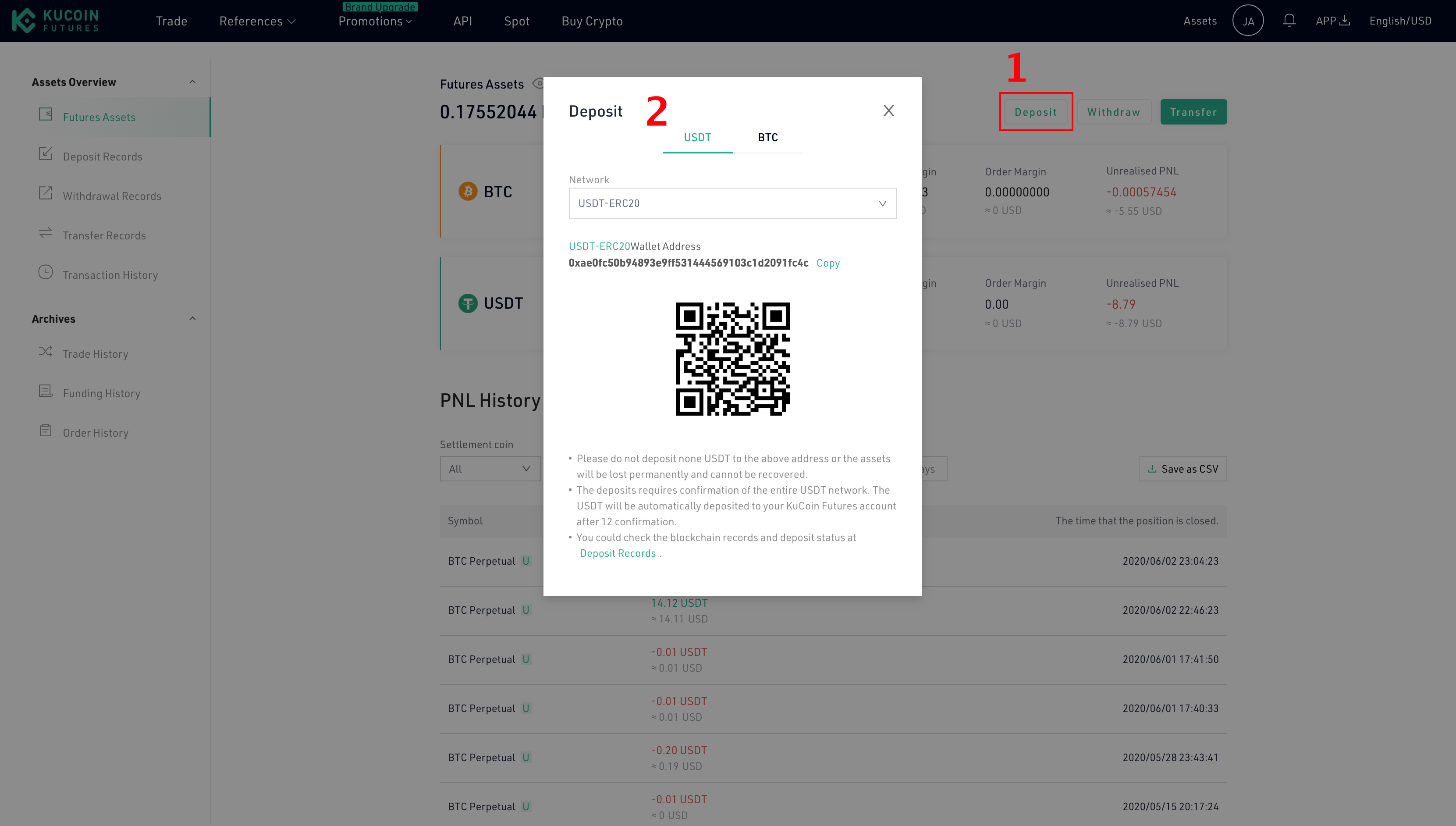

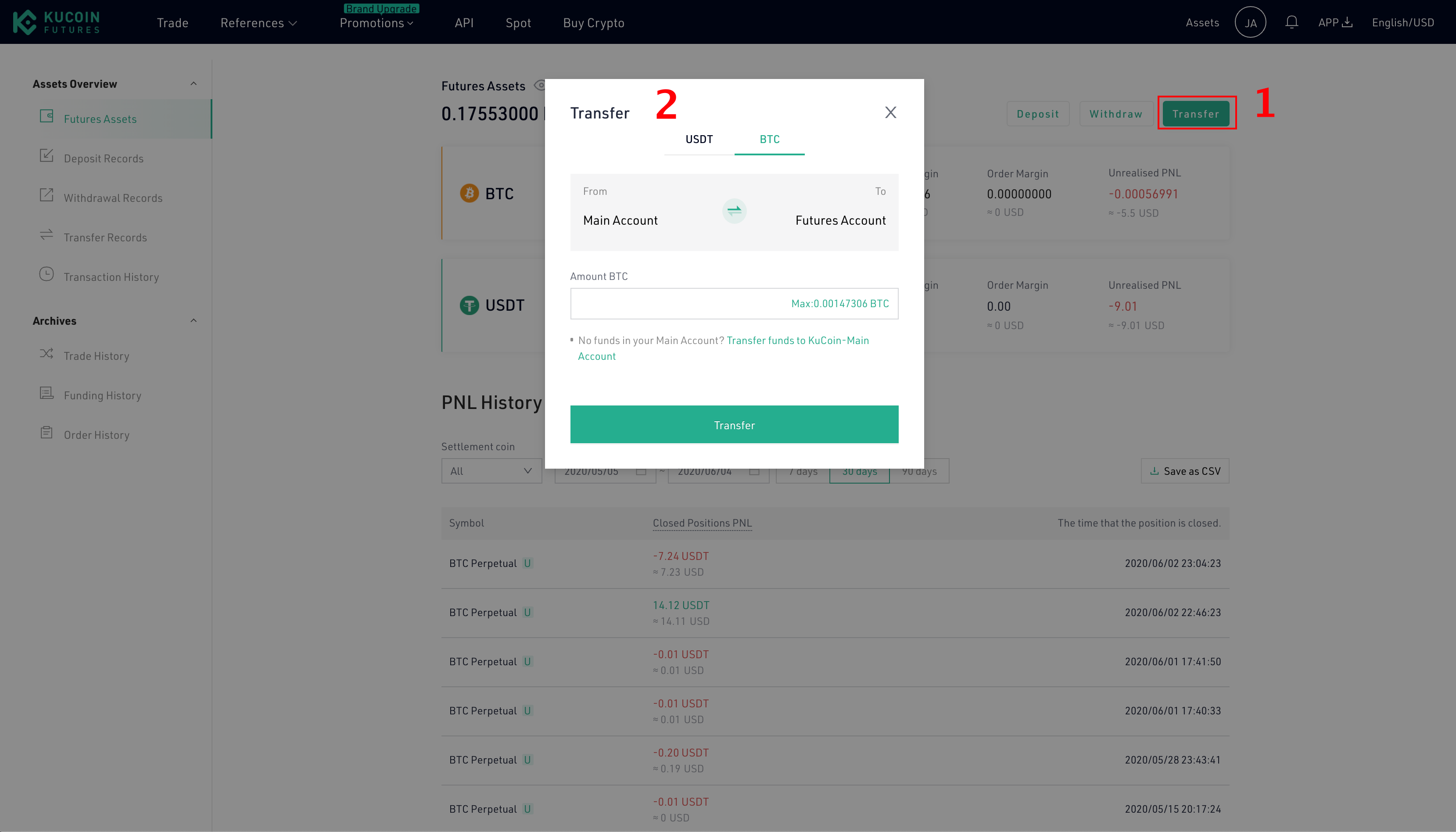

KuCoin Futures Pro offers two ways for your to deposit funds: 1) Deposit and 2) Transfer.

1). If your USDT or BTC are on another platform, you can click “Deposit” directly and deposit the USDT or BTC to the specified address. For USDT deposit, please pay attention to choose the corresponding network protocol in deposit.

2. If you’ve already had USDT or BTC on KuCoin, click “Transfer” and transfer your USDT or BTC to your KuCoin Futures account to start your contract trading.

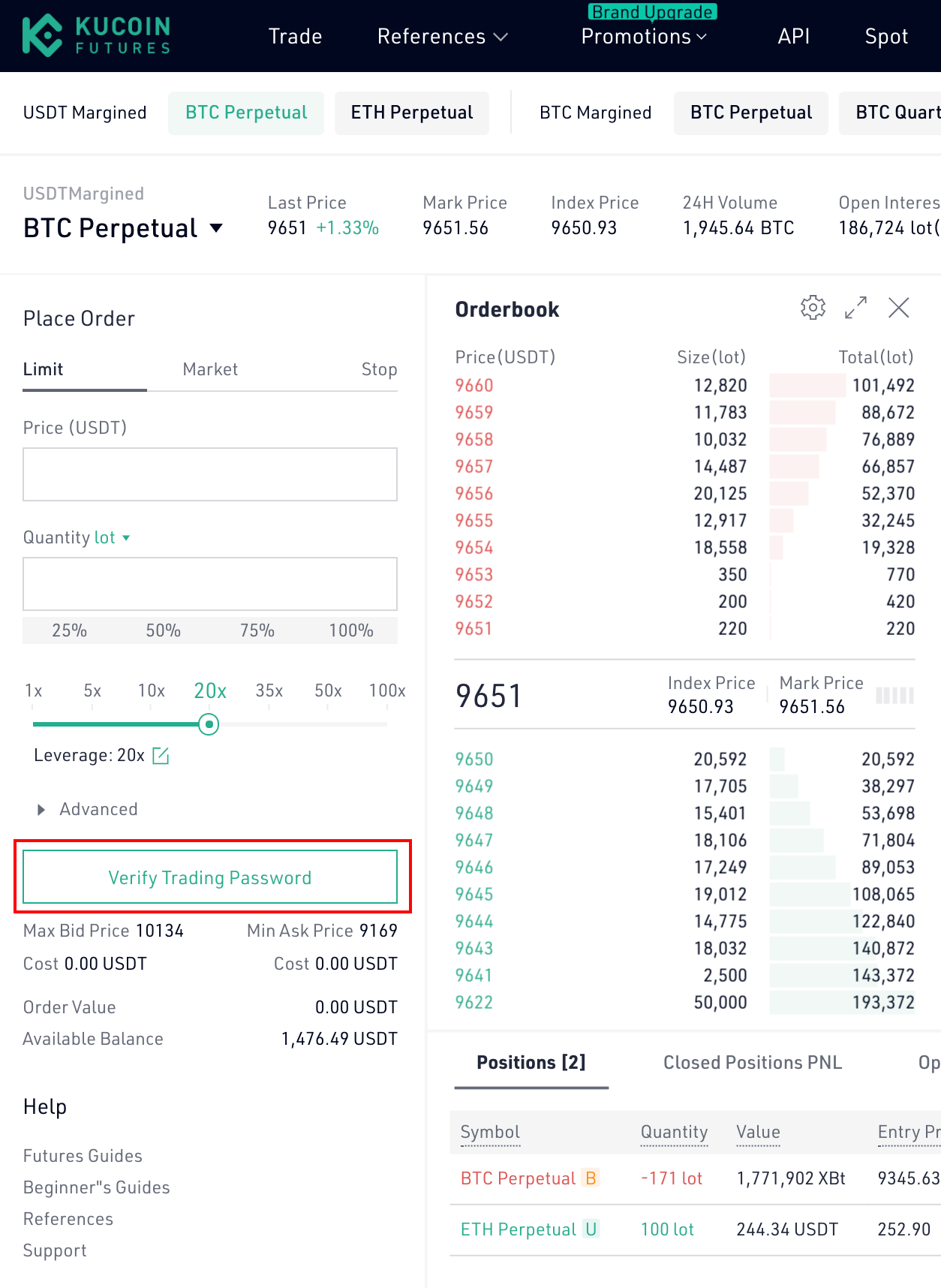

5. Place Order

To place an order on KuCoin Futures Pro, please select the order type and leverage and enter your order quantity.

Order Type

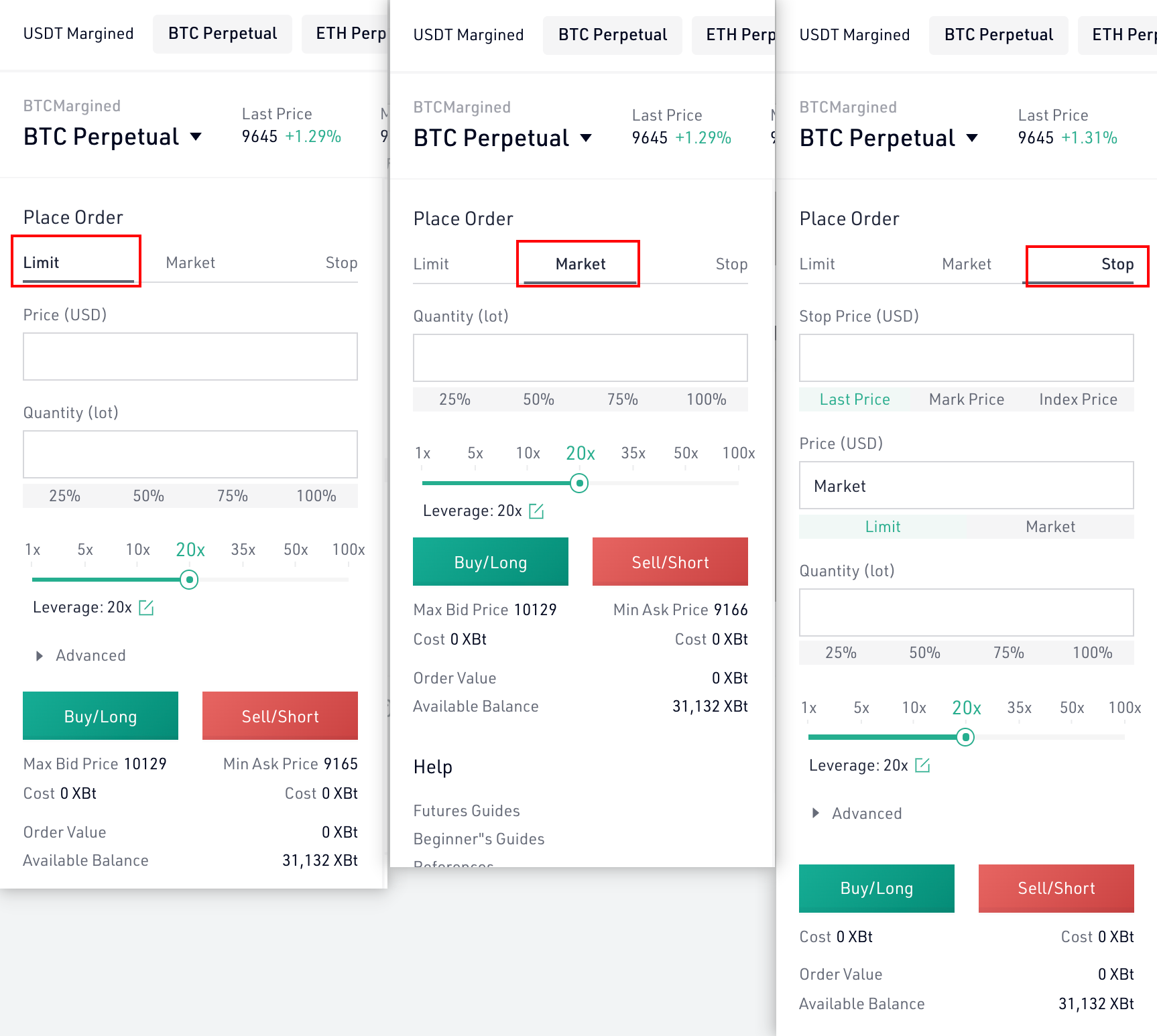

KuCoin Futures supports three types of orders currently: a) limit order, b) market order and c) stop order.

1). Limit Order: A limit order is to use a pre-specified price to buy or sell the product. On KuCoin Futures Pro, you can enter the order price and quantity and click “Buy/Long” or “Sell/Short” to place a limit order;

2). Market Order: A market order is an order to buy or sell the product at the best available price in the current market. On KuCoin Futures Pro, you can enter the order quantity and click “Buy/Long” or “Sell/Short” to place a market order;

3). Stop Order: A stop order is an order which will be triggered when the given price reaches the pre-specified stop price. On KuCoin Futures Pro, you can select trigger type and set stop price, order price and order quantity to place a stop order.

KuCoin Futures Pro supports the switch of order quantity unit between “Lot” and “BTC”. After switching, the display of the quantity unit in the trading interface will change as well.

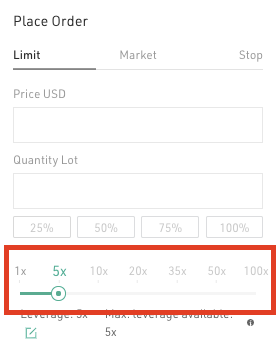

Leverage

The leverage is utilized to multiply your earnings. The higher the leverage is, the greater the earnings you will have and so does the losses you will have to bear, so please be prudent of your choices.

If your KuCoin Futures account is not KYC verified, your order leverage will be restricted. For accounts passed KYC verification, the leverage will be unlocked to the maximum.

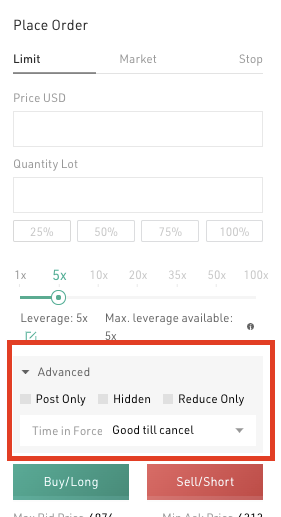

Advanced Settings

KuCoin Futuresoffers advanced settings including “Post Only”, “Hidden” and Time in Force policies such as GTC, IOC, etc. for orders. Please note that the advanced settings are only available for limit or stop orders.

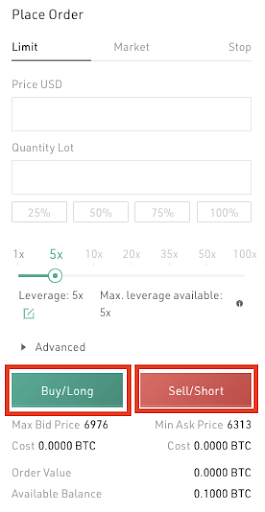

Buy/Long & Sell/Short

On KuCoin Futures Pro, if you’ve already entered the order info., you can click “Buy/Long” to go long your positions, or click “Sell/Short” to go short your positions.

1).If you went long your positions and the contract price goes up, you will earn profit;

2).If you went short your positions and the contract price goes down, you will earn profit.

*Notice (will be displayed below the “Buy/Long” and “Sell/Short” buttons)

The platform has maximum and minimum order price restrictions for orders;

The “Cost” is the needed margin to execute an order and please ensure there’s sufficient balance in your account to place an order.

6.Holdings

On KuCoin Futures Pro, if you have submitted an order successfully, you can check or cancel your open and stop orders in the position list.

If your order is executed, you can check your position details in the “Open Positions”

Quantity: Number of contracts in an order;

Entry Price: Average entry price of your current position;

Liquidation Price: If the price of the contract is worse than the liquidation price, your position will be liquidated;

Unrealised PNL: The floating profit and loss of the current positions. If positive, you have profited; If negative, you have lossed funds. The percentage indicates the proportion of the profit and loss to the order amount.

Realised PNL: The calculation of the realised Pnl is based on the difference between the entry price and exit price of a position. Trading fees as well as Funding Fees are also included in the realised Pnl.

Margin: The minimum amount of funds you must hold to keep a position open. Once the margin balance drops below the maintenance margin, your position will be taken over by the Liquidation Engine and get liquidated.

Auto-Deposit Margin: When Auto-Deposit Margin mode is enabled, funds in the Available Balance will be added to the existing positions whenever liquidation happens, trying to prevent the position from being liquidated.

Take Profit/Stop Loss: Enabling take profit or stop loss settings and the system will perform the take profit and stop loss operations automatically to your positions to prevent funds losses caused by violate price fluctuation. (Recommend)

7. Close Positions

The KuCoin Futures position is designed an accumulated positions. To close positions, you can click “Close” directly in the position area or you can go short to close your positions by placing an order.

For example, if your current position size is +1,000 and you plan to close all positions, which means by the time your position size will become 0;

To fully close all positions, you can place an order to go short 400 positions, by the time the current position size will become +600; place another order to got short 600 positions, and the current position size will become 0.

Or you may also trade like this:

Place an order to go short 1400 positions and by the time, your position size will become -400.

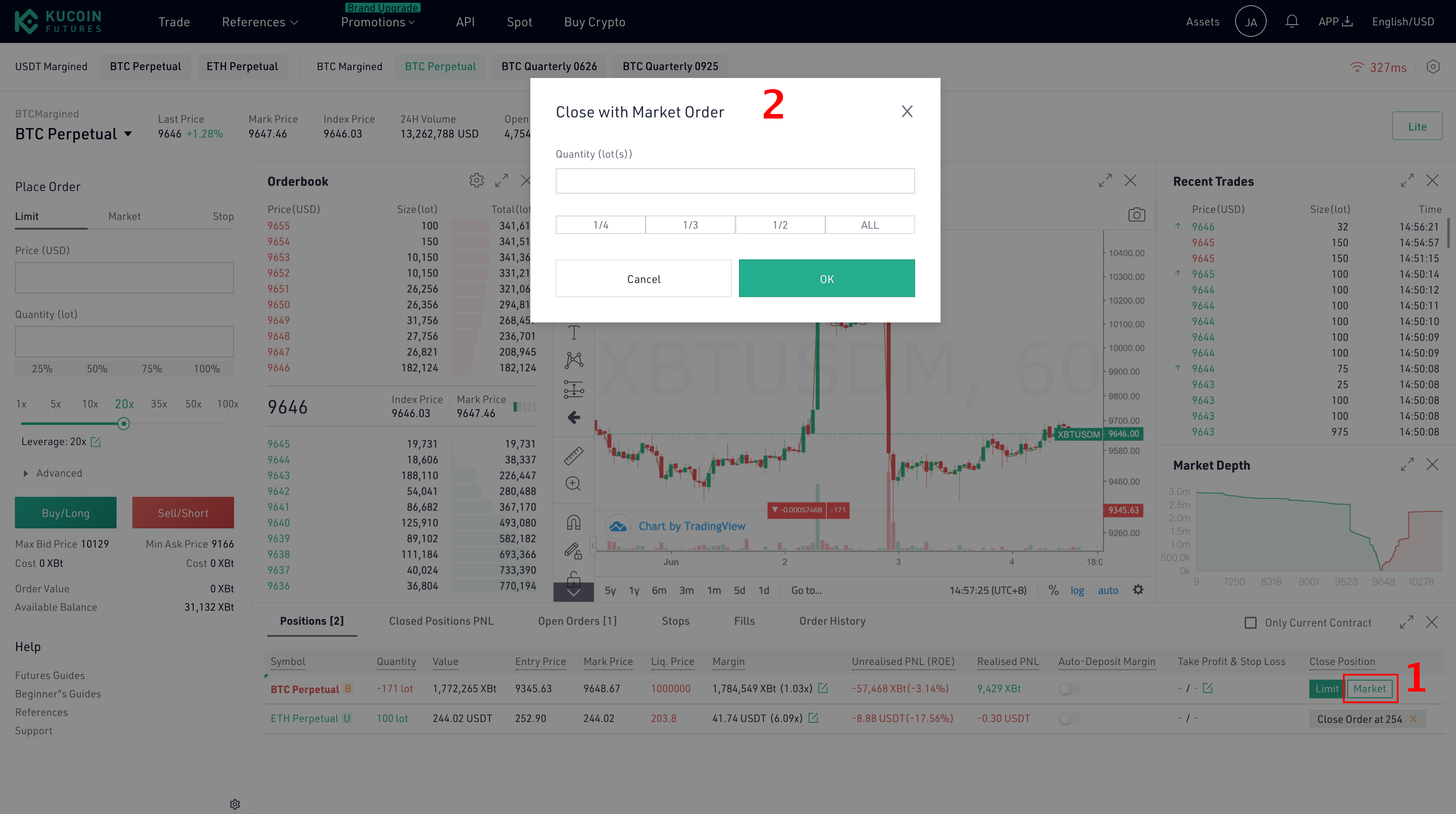

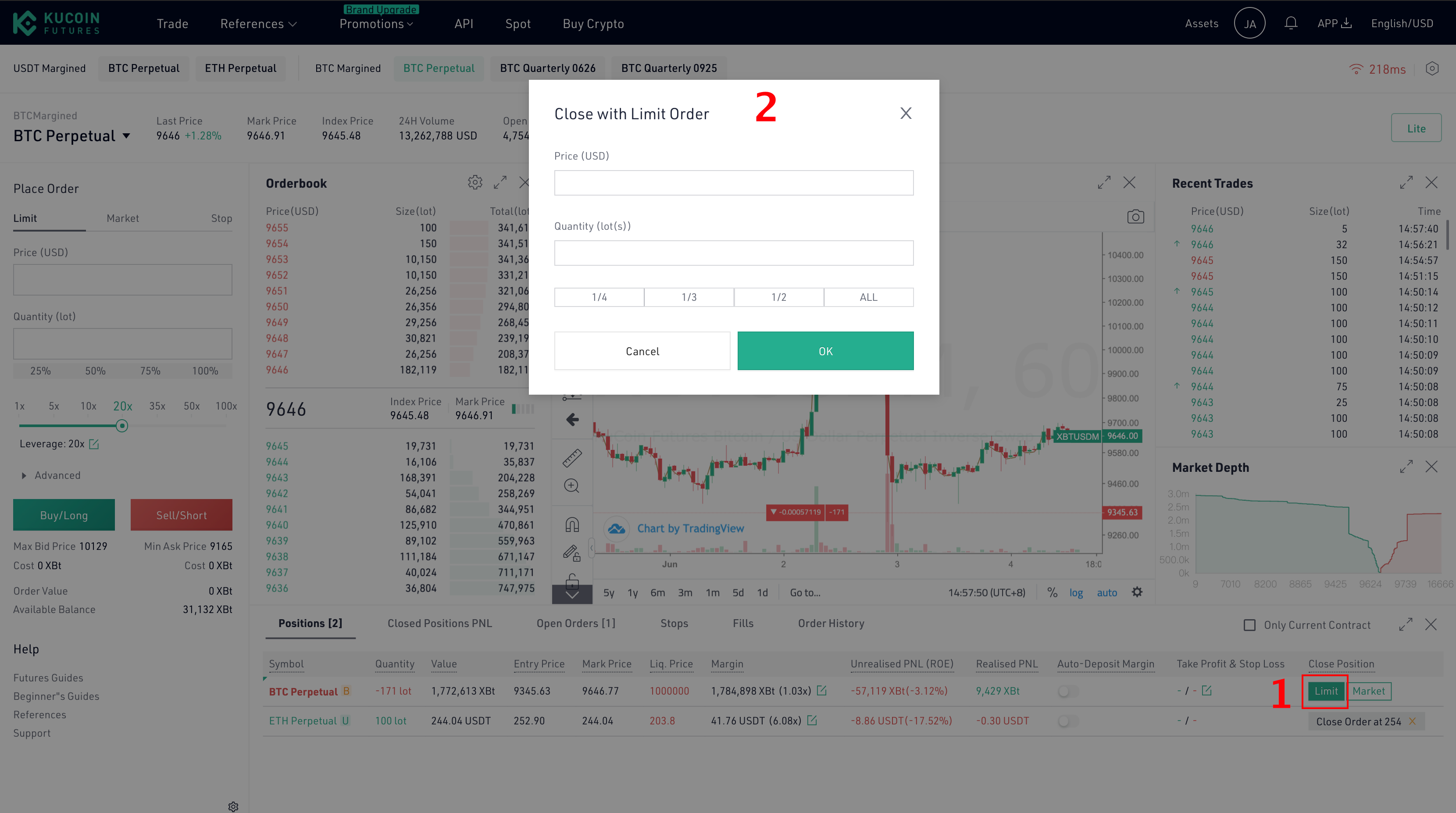

You can close your positions with market or limit orders in the position list.

1) Close with Market Order: Enter the position size you plan to close, click “Confirm” and your positions will be closed at the current market price.

2) Close with Limit Order: Enter the position price and position size your plan to close and click “Confirm” to close your positions.

2) Close with Limit Order: Enter the position price and position size your plan to close and click “Confirm” to close your positions.

The KuCoin Futures Team