KuCoin Options Trading Product Guide

I. Definition of Terms

- Options Trading: An option is a financial derivative that gives the buyer the right to buy or sell an underlying asset at a predetermined price and date. By purchasing a call option, the holder has the right to buy its underlying asset at a future specified date, without the obligation to do so. For a put option, the holder has the right to sell the underlying asset.

- Types of Options: Options are categorized by their exercise methods, such as European, American, and others. KuCoin offers European-style options.

- Underlying Asset: The asset specified in the derivative contract. KuCoin supports options contracts based on Bitcoin (BTC) and Ethereum (ETH).

- Expiration Date: The date when the option contract expires. After this date, the option will be void. This date is shown in the option.

- Strike Price: The agreed-upon price at which the underlying asset can be bought or sold once the option expires. For call options, this is the price at which the buyer can purchase the asset. For put options, this is the price at which the asset can be sold.

- Index Price: The index price of the underlying asset in the options contract, such as BTC or ETH, on KuCoin.

- Mark Price: The fair price of the option calculated using the Black-Scholes model.

- Settlement Price: The time-weighted average price of the underlying asset between 07:30 and 08:00 (UTC) on the expiration date, which is used as the settlement price for the option.

- Premium: The price paid for purchasing an option. The buyer pays the seller a premium, which serves as the cost of the option.

- Call/Put Options: In options trading, 'C' (Call) represents a call option (bullish), and 'P' (Put) represents a put option (bearish). These abbreviations are often displayed in the option descriptions.

II. KuCoin Options Contract Rules

KuCoin offers European-style crypto options, where users can only exercise their options on the expiration date, but can close positions anytime before. Currently, the platform only allows users to trade as option buyers.

| Option Types | Call Options, Put Options |

| Trading Pairs |

Shown as [Asset-Expiration Date-Strike Price-Option Type], such as BTC-241205-75000-C or ETH-241012-5000-P. Example: BTC-241205-75000-C represents a call option on BTC/USDT with an expiration date of December 5, 2024, at a strike price of 75,000 USDT. Example: ETH-241012-5000-P represents a put option on ETH/USDT with an expiration date of October 12, 2024, at a strike price of 5,000 USDT. |

| Underlying Assets | BTC, ETH |

| Pricing/Settlement Asset | USDT |

| Minimum Order Size | The equivalent of 10 USDT worth of options contracts. |

| Exercise Method | Settled in USDT, with settlement occurring automatically at 08:00 (UTC) on the expiration date. |

| Option Unit | 1 option contract represents: 1 BTC for BTC options, 1 ETH for ETH options. |

| Mark Price | KuCoin uses the Black-Scholes model to calculate the real-time fair price of the options. |

| Settlement Price | The time-weighted average price of the underlying asset between 07:30 and 08:00 (UTC) on the expiration date. KuCoin uses this as the settlement price for the option to calculate the exercise amount. |

| Expiration Date | The date the option is exercised. |

| Fees |

Trading Fee: 0.03% Exercise Fee: 0.02% |

| Trading Fee |

Calculated as the lesser of [Trading Fee Rate × Index Price × Option Units × Number of Contracts, or 10% × Premium × Number of Contracts]

|

| Exercise Fee |

Calculated as the lesser of [Exercise Fee Rate × Settlement Price × Number of Contracts, or 10% × Option Profit × Position]

|

| Break-Even Price |

Using 1 option contract as an example: For Calls: Break-Even Price = Strike Price + Premium (per Contract) + Trading Fees For Puts: Break-Even Price = Strike Price - Premium (per Contract) - Trading Fees |

| Position Profit and Loss |

Profit and loss are calculated based on the Options’ mark price and the average position price. Unrealized profit and loss = (mark price - average position price) * number of Options Example: If you hold 0.1 BTC-20251010-9000-C, the average position price is 800 USDT. When the BTC price rises and the Options' mark price becomes 900 USDT, your Options' unrealized profit and loss = (900-800)*0.1=10 USDT. The actual profit will be displayed in the historical transaction/exercise history after the position is closed/exercised. |

III. Profit and Loss Calculation

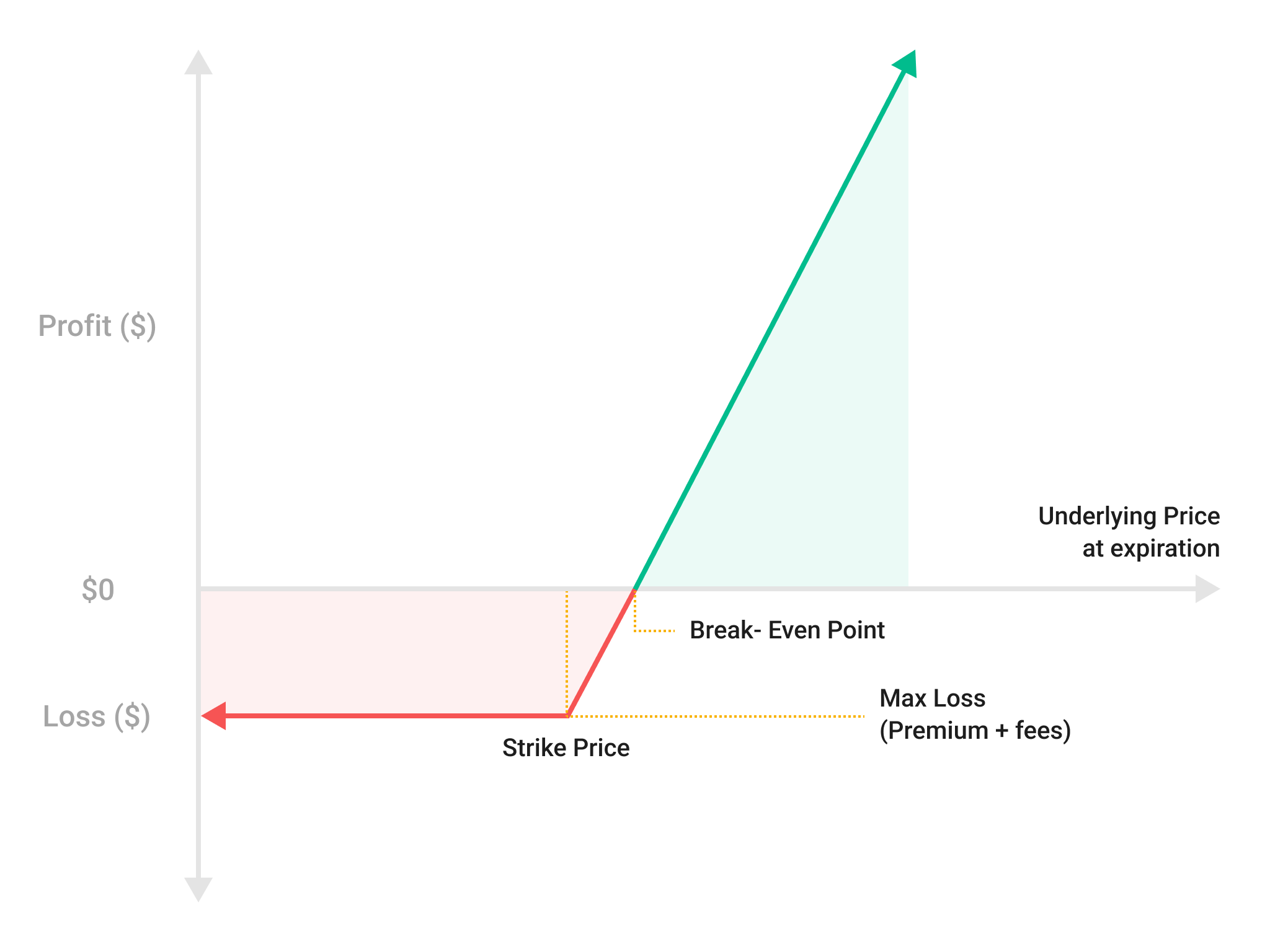

Call Option: Buyer PNL Chart

If the settlement price of ETH on October 1 reaches 4,100 USDT, the user can exercise the option by paying the strike price of 4,000 USDT to purchase 1 ETH from the call option seller. The system will automatically sell the ETH at the market price of 4,100 USDT.

Assuming ETH settles at 4,100 USDT on October 1, net profit can be calculated with the below formulae:

Option Profit = Settlement Price - Strike Price, in this case: 4,100 USDT - 4,000 USDT = 100 USDT

Exercise Fee = Min[Exercise Rate × Settlement Price × Number of Contracts, 10% × Option Profit × Position], in this case: Min[0.02% × 4,100 × 1, 10% × 100 × 1] = 0.82 USDT

Net Profit = Profit - Premium - Trading Fee - Exercise Fee, in this case: 100 USDT - 10 USDT - 0.1 USDT - 0.84 USDT = 89.06 USDT

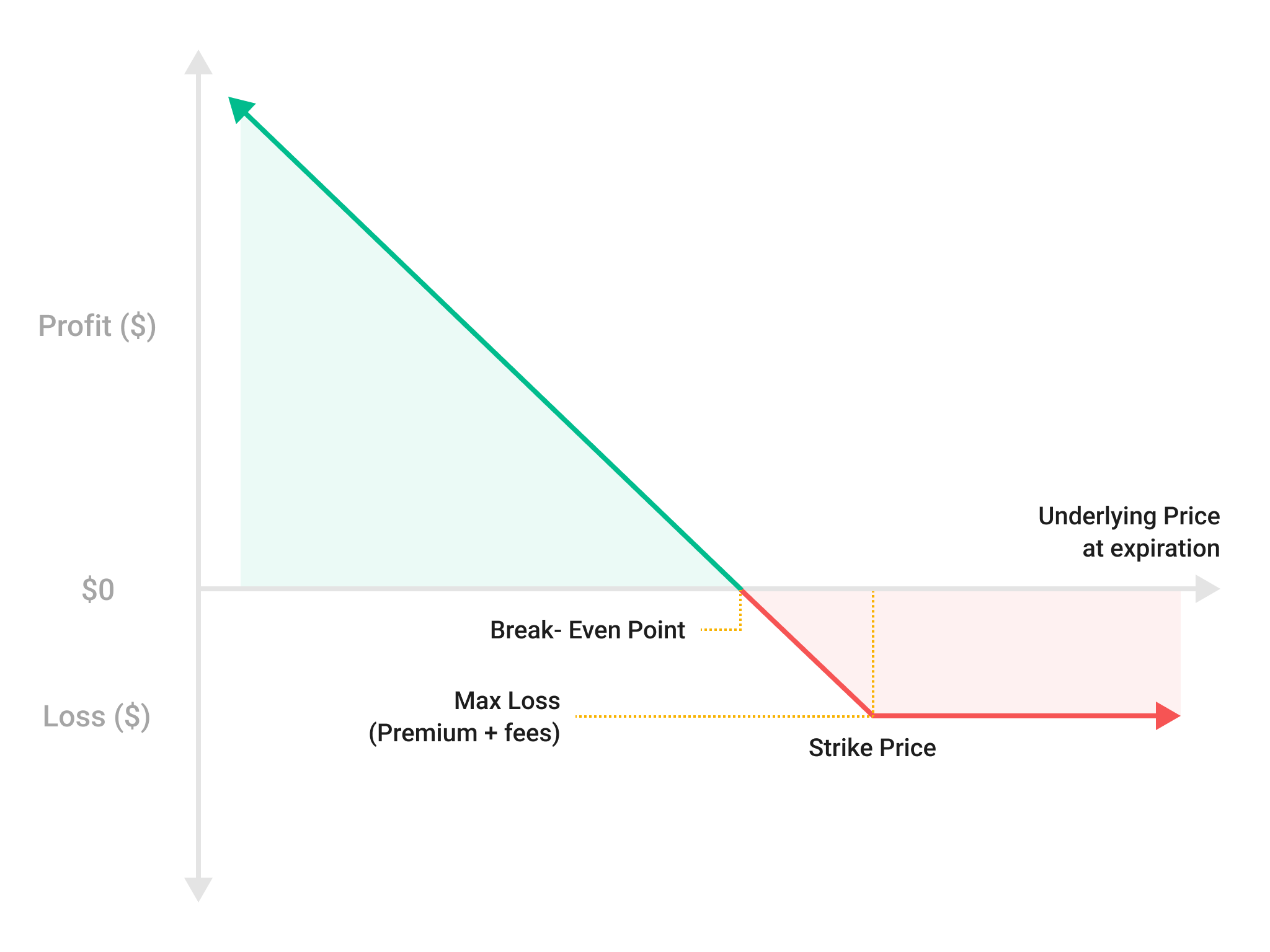

If the settlement price of ETH on October 1 drops to 3,900 USDT, the user can exercise the option. The system will automatically purchase the underlying ETH asset at the market price of 3,900 USDT and sell it to the put option seller at the agreed strike price of 4,000 USDT.

Assuming ETH settles at 3,900 USDT on October 1, net profit can be calculated with the below formulae:

Option Profit = Strike Price - Settlement Price, in this case: 4,000 USDT - 3,900 USDT = 100 USDT

Exercise Fee = Min[Exercise Rate × Settlement Price × Number of Contracts, 10% × Option Profit × Position], in this case: Min[0.02% × 3,900 × 1, 10% × 100 × 1] = 0.78 USDT

Net Profit = Profit - Premium - Trading Fee - Exercise Fee, in this case: 100 USDT - 10 USDT - 0.1 USDT - 0.78 USDT = 89.12 USDT

IV. Advantages of Options Trading

1. Low Cost, High Yields

Options allow users to control larger positions with a smaller upfront investment.

For example, say the current BTC index price is 65,000 USDT. If someone wanted to buy 1 BTC while believing that the price will continue to rise over the next month, the cost comparison between buying the same BTC position in spot vs. in options is as follows:

| I believe the BTC price in one month will be | Profit | ROI | End Result | |||

| 5,000 USDT | 5,000 / 65,000 = 7.69% | Profit from Spot Price Difference | ||||

| 3,000 USDT | 3,000 / 2,000 = 150% |

Lower cost, higher returns on investment |

Compared to the spot market, a trader would only need to pay the option premium to enter the market, achieving their expected returns with lower costs.

2. Limited Losses, Lower Risk

In options trading, both parties in a trade must follow the contract's terms for settlement. The buyer has the right to decide whether to exercise the option, which allows them to limit potential losses as much as possible.

The buyer’s maximum loss is capped at the premium paid for the option, with no additional margin requirements, ensuring losses are controllable.

Unlike perpetual contracts, where short-term market volatility can lead to liquidation, options trading is only influenced by the final settlement price on the expiration date.

3. Larger Decision-Making Window

Once a user buys an option, they have a window of time to assess market conditions. The small premium guarantees enough buffer time for making informed decisions before expiration.

4. Diverse Trading Strategies

While futures trading offers only long and short positions, options trading allows for 4 combinations: buying calls, buying puts, selling calls, and selling puts. Options traders can base their strategies not only on the asset’s price movements, but also on their time horizon and volatility.

Risk-averse investors can choose to be option buyers, avoiding high-risk exposure. On the other hand, those who are risk-neutral or more risk-tolerant may even opt to be option sellers. With multiple options strategies available, traders can achieve different risk-reward outcomes.